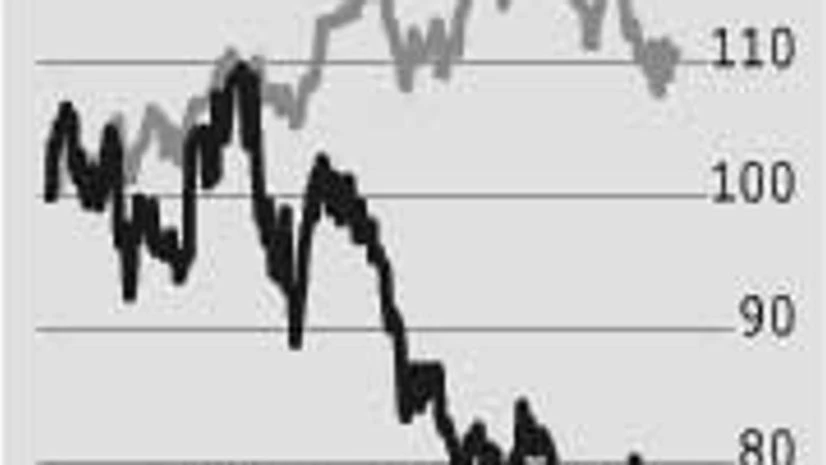

Weak demand, higher input costs and pricing pressure have together dented JSW Steel’s March quarter performance. Impairment in abroad subsidiaries further impacted the standalone numbers during the quarter. Weak demand and higher costs led to lower volumes during the quarter. While the Street was building in lower volumes and lower realisations, the actual decline was higher than estimated. JSW Steel’s standalone revenues fell 10.4 per cent year-on-year (y-o-y) and 4.5 per cent quarter-on-quarter to Rs 10,982 crore. The operating income of the standalone business fell 26 per cent y-o-y and 21 per cent sequentially to Rs 1,673 crore.

The sharp drop in operating income was due to lower realisations and lower operating income per tonne of steel sold. During the quarter, JSW Steel’s Ebitda per tonne (which reflects the profitability) stood at Rs 5,469 a tonne against Rs 6,988 a tonne in the December quarter and Rs 8,052 a tonne in the fourth quarter of FY14. Realisations stood at Rs 36,863 a tonne, down 10 per cent y-o-y and six per cent q-o-q.

Coupled with domestic pressures, JSW Steel’s standalone business also has taken a hit due to impairment in its foreign subsidiaries. The company has made a one-time provision of Rs 105 crore for the same, of which Rs 64 crore is towards JSW US Inc and Rs 41 crore is investment in other subsidiaries. The company’s subsidiaries also reported losses. JSW Coated Products reported a loss of Rs 26 crore, while JSW Chile reported a loss at Ebitda level of $10.3 million. JSW US Plate and Pipe Mill reported an Ebitda of $0.13 million. Analysts believe there is stress in the international assets.

A combination of all these factors has resulted in JSW Steel’s consolidated revenue falling 12 per cent y-o-y and four per cent q-o-q to Rs 12,364 crore. Consolidated operating profit declined 33 per cent y-o-y and 27 per cent q-o-q to Rs 1,683 crore. The March quarter has been particularly bad as benefits of lower input costs have not materialised. Going forward, Goutam Chakraborty of Emkay Global believes systemic demand for steel would gradually pick up and the business would see stabilise.

)