Polymer prices are likely to rise by 10 per cent in one month, following a sharp increase in crude oil prices. Flexible packaging material makers, who use polymers in their manufacturing processes, have started shifting to value-added products to protect their margins.

The price of polypropylene, a derivative of crude oil, jumped by five per cent in December and is currently trading at $1,050 a tonne following the spike in crude oil prices. Brent crude jumped by 19 per cent after the Organization of Petroleum Exporting Companies (Opec) decided to cut output on November 30. It is currently trading at $54.50 a barrel.

“While crude prices have increased by 19 per cent, there has been a five per cent increase in polypropylene prices, as the material tends to move in the direction of crude with a lag of approximately one month. We estimate a spurt of at least 10 per cent in polymer prices in the next four weeks,” said Neeraj Jain, Chief Financial Officer, Cosmo Films, a leading flexible packaging material manufacturer in India.

More From This Section

“Flexible packaging material manufacturers work on a cost-plus model, under which the volatility in crude oil prices is completely passed on to the client,” said a senior industry official.

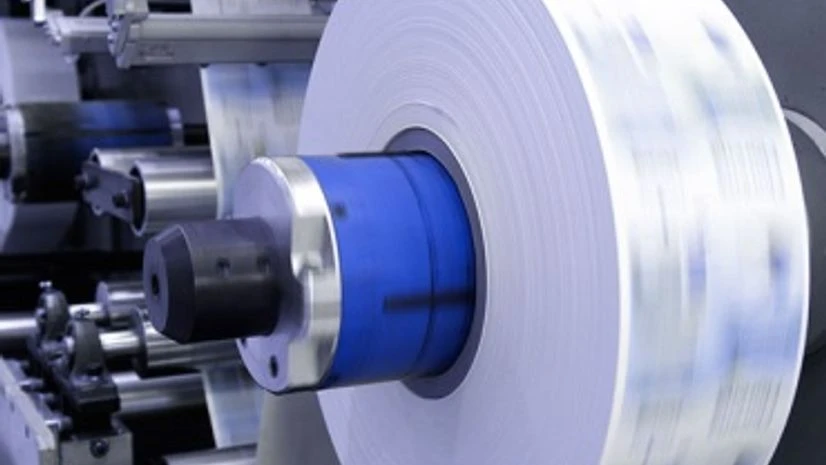

Meanwhile, Cosmo Films has also been focusing on internal efficiency in order to have an edge over other companies in which the dependence on traditional (commodity) films is higher. It is taking initiatives to improve profitability through various cost-saving measures, apart from increasing the share of value-added films to its top line, over the next two years.

The current contribution of traditional films and specialty films to company's top line is about 50 per cent each in value terms. However traditional films constitute 60 per cent of the product mix by volume.

EBIDTA has dropped for most other Companies in the flexible packaging segment due to pressure in the gross margins of commodity films; however Cosmo Films has negated the impact of a drop in margins, with improvements in the sale of specialty films and in operational efficiencies.

"Cosmo films expand margins from 6.3 per cent to 11.8 per cent in FY16, on account of improved throughput, reduction in power costs and improved product mix. The company had cost savings of around Rs 25 crore, on account of several energy-saving initiatives,” said Shivani V Vishwanathan, an analyst with Way2Wealth Brokers Pvt. Ltd.

The industry as a whole has embarked on the next level of expansion, albeit with a gap of 6-8 months between two phases, giving time to each expansion to be successful. But this only till the applicable for the next two years since the lead time for expansion is two years.

Meanwhile, there has been a keen shift from PET to BOPP as the preferred choice of packaging for the end-user industry. It is expected that the scale will shift in favour of BOPP films due to their superior barrier proprieties and greater environment friendliness, said a report from Way2Wealth Brokers.

)