Price cuts taken by most fast moving consumer goods (FMCG) companies across products have not translated into higher volume growth for them, as indicated in the June quarter results.

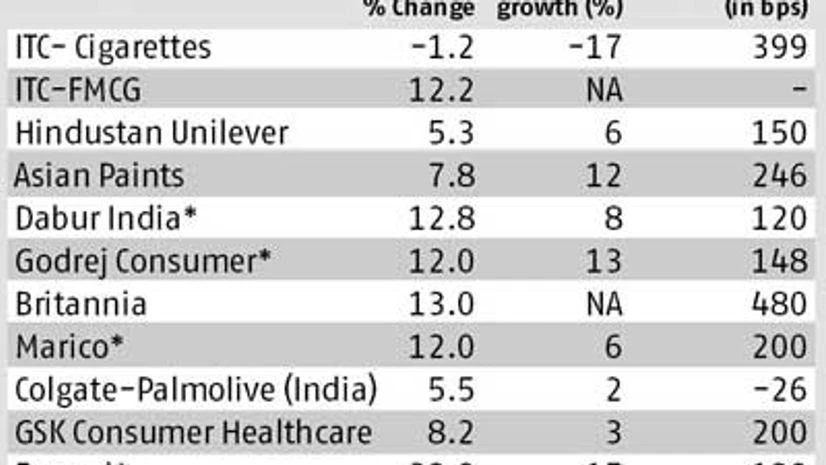

Of the top 10 FMCG companies by market capitalisation, six saw lower revenue growth as compared to the March’15 quarter. A fall in realisations due to price cuts was not compensated by an equivalent rise in volume growth.

Falling input costs (as a percentage of sales) due to softening of raw material and crude oil prices have aided strong margin expansion for FMCG companies. Notably, nine saw strong Ebitda (earnings before interest, taxes, depreciation and amortisation) margin expansion. These gains could have been higher if not partly passed on to the end-consumer. But, despite lowering prices, volume growth for many FMCG companies did not pick up.

Further, companies reinvested part of the benefits in advertising and innovations. Apart from cutting product prices, FMCG companies have also adopted promotions, offers and increased grammage to boost volumes. These however are only short-term measures and have only enabled them to protect the volumes, rather than increasing these. Abneesh Roy, associate director, institutional research, Edelweiss Securities, says: “Price cuts and promotional offers are important but will not aid sustainable volume growth for FMCG companies. We believe rural demand will continue to be under pressure in the medium term.”

Nestle India has been excluded from the list of these companies in the analysis, as its results were impacted by the regulatory overhang around its Maggi brand. While ITC's revenues fell for the first time since the March 2009 quarter, this was due to falling cigarette volumes and softness in other segments such as agriculture and paper. Though ITC's non-cigarette FMCG business' revenue growth was at a five-quarter high of 12.2 per cent, the segment posted operating loss and continues to witness volatility in profitability.

Positively, Asian Paints, Dabur, Godrej Consumer and Emami were outliers. Their revenue growth improved from the March quarter.

So, what are the key factors impacting the top line? Continued sluggishness in rural demand is one. Withdrawal of excise duty benefits and an unexciting monsoon were others. Even as urban consumption is showing some green shoots, the improvement is likely to be very gradual, believe analysts.

Nitin Matur, consumer analyst at Societe Generale, says: “We believe companies will have to work very hard on both advertising and innovation to gain volumes. If things remain on track, volume growth could witness some uptick in the second half of this financial year. The uptick, though, will be much smaller and gradual in nature.”

He believes companies will have to focus on reducing the price premium of their products over regional players to achieve the right pricing. Most analysts also believe the high Ebitda margins are not sustainable. A high base effect will come into play over the next two quarters. Second, a continuous increase in innovations and ad spending will pull down the margins.

)