Eight years back, Samsung became the leader in the mobile phone industry in India with the roll out of "Galaxy S3" from its Noida facility.

Today, as the Indian smartphone market witnessed a modest 8 per cent (Year-on-Year) growth in 2019, the South Korean giant registered declining shipments among the top five brands.

The last eight years or so have seen Chinese invasion like never before (Chinese smartphone brands captured 72 per cent of the Indian market in 2019 compared to 60 per cent in 2018), launching devices with top-notch features while taking the average selling point (ASP) further down.

A premium player from the very beginning, Samsung faced the heat as smartphones became more affordable with each passing year, and players like Xiaomi and Vivo captured the affordable to mid-premium segments, forcing the company to launch online exclusive M-series in the budget segment and revamping the 'A' series in the mid-segment, which have so far been successful attempts.

The company understands that it is best known for the Rs 30,000 and above segment and has begun 2020 by launching 'Lite' devices of its successful premium brands -- along with taking positive strides in the 5G and foldable space.

"The mobile business aims to improve profits by expanding sales of premium models, such as the enhanced 5G lineup and new foldable devices," the company said while declaring its financial year 2019 and Q4 results on January 30.

Samsung expects smartphone revenues to rise on improved product mix with the launch of new flagship models and foldable devices.

More From This Section

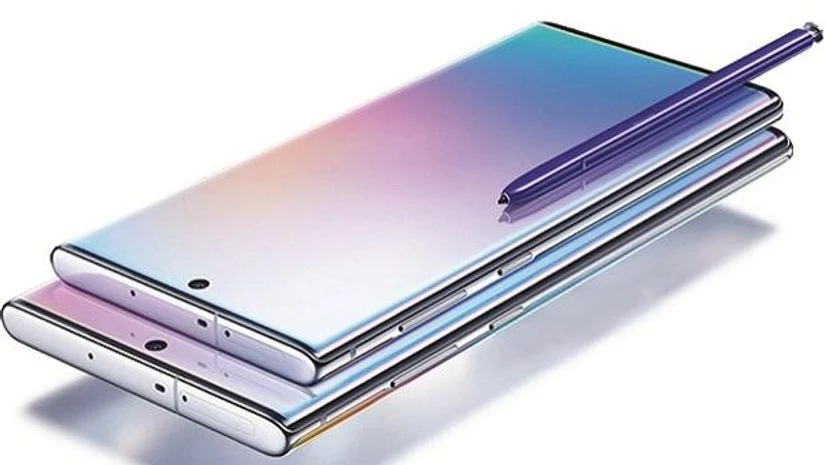

In India, the company now seems to be back on its premium strategy, with launching 'Lite' version of S10 and Note10 Lite in the range where OnePlus currently rules.

According to Navkendar Singh, Research Director, IDC India, considering the size and potential of the Indian market, it is certainly not saturation for the market or any brand like Samsung.

The other brands in the market are relatively new entrants while Samsung has been in India for more than two decades now as a lifestyle brand.

"These brands are able or willing to infuse freshness in their brand in terms of marketing and investments in retail etc," Singh told IANS.

Samsung has, in fact, actually started doing well in the online space for the past couple of quarters.

Its Galaxy M series, in particular the Galaxy M30s device, performed well in the online segment, helping revive its online share in the fourth quarter of 2019 at an all-time high of 16.6 per cent.

However, this happened at the cost of ceding space to brands like Vivo in the offline space.

"This is interesting since offline has always been Samsung's forte for a ling time," said the IDC executive.

For 2020, market competition is forecast to intensify as manufacturers increasingly adopt high-performance components, including application processors (APs), memory and cameras.

In response, Samsung plans to differentiate its premium smartphones by expanding 5G adoption and introducing new designs for foldable products.

"The company is trying hard to get back to growth path. To revive in 2020, it needs to build portfolio across price tiers. Launching the 'Lite' version of its flagship phones S10 and Note 10 is a good step in that direction," said Shilpi Jain, research analyst with Counterpoint Research.

"Also, it needs to be more aggressive in its marketing strategies across all platforms to fight the competition," she added.

Samsung aims to improve earnings by expanding sales of premium smartphones and enhancing the competitiveness of its mid to low-end lineup.

Tweaking its portfolio would be a godsend for Samsung to revive its growth path.

In India, Samsung needs to go aggressive in the $200 to $500 segment.

"This segment is expected to see growth from the upgraders this year. Almost all brands are expected to bring in models in this price range and the competition will be very stiff," said Singh.

)