With over 50 per cent of the market under its belt, IndiGo Airlines has no doubt been the king of low-cost carriers in the country. But the good times now seem to be under threat.

Soon, IndiGo will have to defend its market from AirAsia, which has entered India in collaboration with the Tatas, on the one side, and fend off competition on international routes, especially to West Asia after Jet Airways's alliance with Etihad, on the other. Experts say while AirAsia will kick off a price war by dropping fares, an oft-repeated strategy that it is known for globally, the Jet-Etihad partnership will stir up competition on routes between India and West Asia by offering more connectivity to woo passengers.

But IndiGo is no sitting duck. The low-cost carrier, which has successfully kept its costs down and has built up efficiencies which are comparable to global low-cost carriers, is putting together a "stick to the knitting" strategy to take on the twin challenges. The airline, of course, is keeping its plans closely guarded, but Business Standard talked to its associates like travel companies, vendors and aircraft manufacturers to get the broad contours of its strategy.

Building on strength

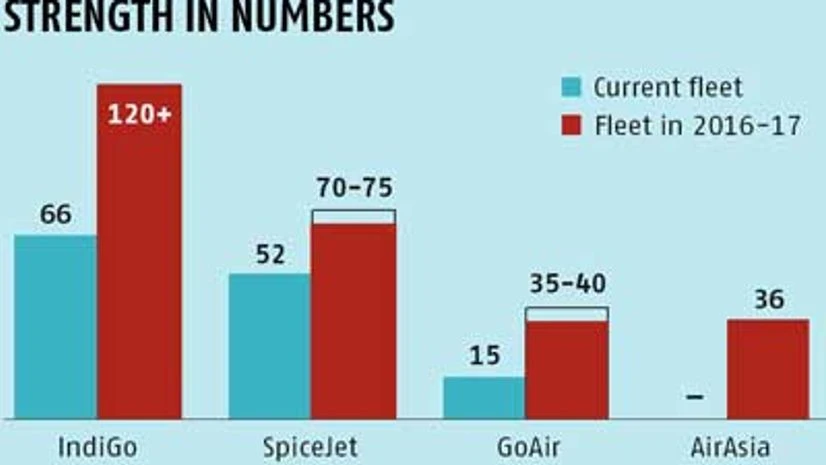

To put things into perspective, based on new aircraft delivery schedules, IndiGo will continue to have a lion's share of over 45 per cent of the capacity of all low-cost carriers put together (including AirAsia) by 2016-17 (currently it is 49 per cent). In the same period, AirAsia will acquire 36 new aircraft, a fleet that will be a little over a third of IndiGo's 120 aircraft. If aircraft capacity is an indication of market share, AirAsia will not have more than 15 per cent of the market. Even that, analysts say, will be carved out from smaller low-cost carriers, not IndiGo. In fact, AirAsia's fleet size would be smaller than even GoAir, if trends based on its orders are anything to go by, and it will remain the smallest low-cost carrier in terms of fleet.

Also, in terms of fleet choice, AirAsia will not have any special edge as both AirAsia and IndiGo will be flying the same aircraft. IndiGo will get delivery of the A-320 Neos by the end of 2015, more or less the same time as AirAsia.

These planes claim to save up to 15 per cent in fuel costs, which is a key edge in a business where cost management is essential to stay afloat. IndiGo, which has ordered 150 of them, is slated to replace its entire fleet with Neos by 2021-22. This means it will not be at a disadvantage against AirAsia in terms of plane technology.

Those in the know also say IndiGo will stick to its existing plan of having just one type of aircraft rather than go the SpiceJet way and introduce smaller aircraft. SpiceJet has added Q-400 Bombardiers to its fleet so that it can fly to regional airports and smaller cities where even narrow-bodied aircraft cannot land. The reason is simple: two set of plane models with different pilots, spare parts, ground maintenance and coordination of schedules only increase costs of operations which could be suicidal for a low-cost carrier. IndiGo is instead expected to use the 18 new aircraft that it will get in the next two years to fly to new routes where narrow-bodied aircraft can land.

"There are about 12-13 cities where IndiGo does not fly now; it will do so in the next phase" says a vendor close to the company.

The idea is to increase the number of cities to which the airline flies from 28 currently to around 40 by 2016-17. For instance, it does not fly to cities like Surat, Bhavnagar, Tirupati, Amritsar, Leh and Bhopal.

So far, AirAsia only has plans to fly to 10 or 12 cities with Chennai and Kolkata as the base. Surely, there will be common cities where IndiGo and Air Asia will come in headlong collision, or where they may even have the same time slots. But what will give IndiGo an edge is that by 2016-17, AirAsia will be flying to fewer cities, only a fourth of the number of cities connected by IndiGo.

Global challenge

On the international routes too, IndiGo's strategy remains the same. Unlike SpiceJet, which has preferred to fly uncharted routes like Kabul and Guanzhou, IndiGo operates international flights only to the traditionally safe markets where passenger numbers are ensured but competition is also cut-throat. These include Dubai, Muscat, Bangkok and Singapore. The airline, those in the know say, has no plans to expand to too many new cities. Instead, it might, however, look at increasing its frequency to the existing destination. For instance, it has already asked for 5,000 more seats a week on the India-Dubai route. It is also planning to increase its frequency to Muscat.

Cost, of course, is the guiding principle of its strategy. Increasing frequency will help IndiGo in reducing operational costs as it will be utilising the infrastructure that it has already created for handling more flights. So, the costs can be spread over more aircraft.

The strategy also sits well with the existing dynamics of the India-West Asia sector. Emirates, which has dominated this market, currently prefers to keep its fare on the India-Dubai sector much higher than low-cost carriers as it is primarily interested in passengers who are going onwards to the US and Europe. But with the Ethiad-Jet partnership providing an alternative to passengers going to the US and Europe via West Asia, experts say Emirates will lose some business. "With so much capacity being created by Jet Airways and Etihad, fares in the sector offered by these airlines are bound to fall. The pricing gap between low-cost carriers like IndiGo and full-service airlines will also reduce, creating a challenge for all airlines," says a senior executive of an airline which flies to West Asia.

IndiGo, those in the know say, can do two things: it can drop prices further to maintain the gap and squeeze its margins, or it can fight the big boys by increasing the number of flights, making it unviable for them to drop fares.

In other words, based on the current scenario, in order to woo low-cost customers, Emirates will have to slash prices in two flights which have time slots close to that of IndiGo. But if IndiGo increases the frequencies, Emirates will have to slash prices across all flights which would impact its profit margins.

Surely, AirAsia could shake the market. But no matter what shape the industry takes in the months to come, IndiGo is not going to yield its predominant position easily.

INDIGO'S GAME PLAN

- IndiGo will have over 45% of the capacity of all low-cost carriers in 2016-17

- It will get delivery of fuel-efficient A-320 Neos from end 2015

- 12-13 new cities will be added in two years, taking the total destinations to 40 by 2016-17

- It plans to increase frequency on the India-Dubai and India-Muscat routes

Source: Companies & industry estimates

)