Financial conservatism with strong execution. That’s the mantra of Shree Cement, the country’s most successful and priciest cement company on bourses right now. Shree Cement’s stock has become a multi-bagger as investors fell over each other to get a slice of the industry’s best balance sheet and growth profile. The company’s market capitalisation is up five times in the last five years, catapulting its promoter B G Bangur to the list of 10 richest Indians.

At its current stock price, Shree is now India’s second-most valuable cement maker, with over Rs 59,000-crore market cap after the industry leader UltraTech Cement (Rs 108,000 crore), despite it being the fourth biggest in terms of revenues and profits in FY16. At the current stock price, promoters’ stake in Shree Cement is now worth Rs 38,000 crore (about $5.6 billion).

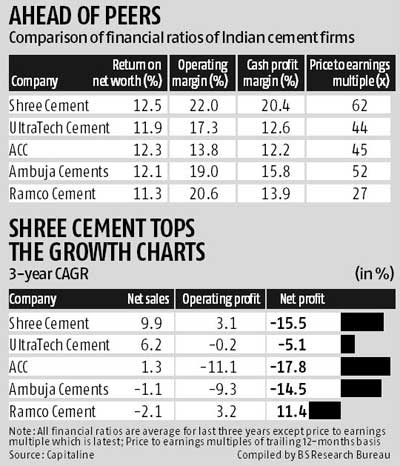

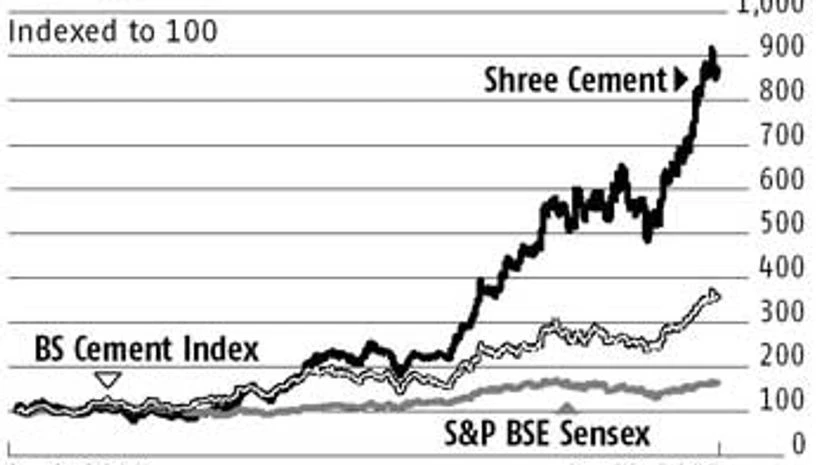

Shree Cement has been an outperformer by a long-margin. The stock price is up nearly nine times since January 2010, against 60 per cent rise in BSE Sensex and 160 per cent rise in BSE Cement Index during the period.

Analysts believe that more juice is left in the stock given its industry leading financial matrix and the headroom to grow faster. “We continue to maintain ‘buy’ on the stock as we agree that the sector fundamentals are slowly turning around and Shree Cement’s return on assets continue to increase the gap with all large cap peers. In FY16, the gap expanded further by nearly 1,000 basis points over UltraTech, ACC and Ambuja Cements,” Manish Saxena and Sharif Hadimani of Edelweiss Securities wrote in a recent report on the company. One basis point is one-hundredth of a per cent.

What the Dalal Street likes the most about the company is its ability to generate cash. In the last three years, Shree Cement has generated nearly Rs 20 worth of cash profit for every Rs 100 worth of net sales on average, against industry average of 12-15 per cent. Besides, it deploys bulk of its incremental cash generation for funding growth, unlike many of its peers.

“Unlike majority of cement players, wherein capital deployment is for servicing debt/equity (dividends), Shree Cement’s capital allocation is for putting up cement capacities — where cash return on capital employment is in excess of 30 per cent. Our analysis indicates the company is well set to enhance capacity more than 2X,” say Saxena and Hadimani of Edelweiss.

This more than justifies the valuation premium that the company enjoys over its peers. At its current stock price, Shree is trading 62 times its trailing 12 months’ earnings, upto 50 per cent premium to the corresponding valuation ratio of most of its larger peers. Others, however, see risk in Shree’s record high valuations.

“No doubt, Shree Cement has grown faster than its peers and offers a compelling story in current environment, but the valuation has gone too far, making it tough for new investors to make money,” says Dhananjay Sinha, head, institutional equity, Emkay Global Financial Services.

He attributes this to the scarcity premium that the company enjoys in the current low growth environment. But then, scarcity premium is a function of liquidity flows and relative growth in other companies and sectors. This raises the risk of a mean reversion in Shree Cement valuations if sentiment on Dalal Street turns bearish.

In the past three years, Shree Cement’s average return on equity has been 12.5 per cent, 50-100 basis points higher than peers and many times better than other commodity producers such as steel makers; but is much below what cash rich firms in FMCG, pharma and IT report. Nevertheless, its valuation ratios are higher than many of the defensive stocks. This raises the downside risk for the stock in the case of market downturn.

)