Till a few years ago, Shree Renuka Sugars was a company to watch for. The "emerging company", led by its young vice-chairman and managing director, Narendra Murkumbi, was bagging successive business awards for excellent performance. In his thanksgiving speeches, Murkumbi always credited the success to his mother, Vidya for her blessings.

But the good luck of Shree Renuka Sugars seems to have run out. On the one hand the sugar cycle has turned unprofitable, on the other debt on the company's books piled up by two costly Brazilian acquisitions continues to swell. Higher interest rate and a falling rupee kept adding to Shree RenukaSugars' interest outgo.

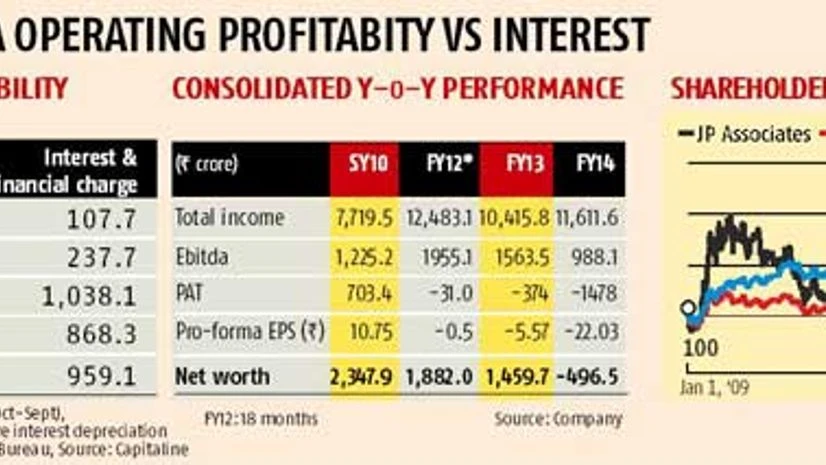

The company's debt that stood at Rs 1,343 crore in September 2009 has grown to Rs 9,976 crore in March this year. Its interest outgo was Rs 959 crore in 2013-14 compared with the Rs 238 crore in sugar year 2010 (the sugar year coincides with the sugar season) which eroded its profits. Shree Renuka Sugars made a profit of Rs 703 crore at the end of sugar year 2010 but reported a loss of Rs 1,478 crore in 2013-14. The company earlier followed the October-September sugar year as the financial year but shifted to April-March year after 2010.

Not surprisingly, the stock which scaled to its intra-day all-time high of Rs 123.50 in January 2010 plummeted to a multi-year low of Rs 14.50 last August. And although it rose to Rs 32 levels in June this year, it is back to Rs 16 levels currently.

What went wrong?

Riding on the back of good domestic performance, in 2010 Shree Renuka decided to invest in South American sugar market at the peak of sugar cycle. But its acquisitions of Renuka Vale do Ivai and Renuka do Brasil S/A (Equipav) failed to generate enough money to repay loans.

Though Shree Renuka Sugars' operational global crushing capacity stand at 22 million tons per annum (MTPA) through eleven mills, its prospects now hinge more on Brazilian operations as the company has more than 60 per cent (13.5 MTPA) capacity in Brazil.

Besides, the sugar prices are not in favour. In home markets too, the company is facing similar surplus conditions. The company has seen declining profitability despite uptick in turnover. While the total income improved from Rs 7,719 crore in SY10 to Rs 11,611 crore in FY14, its profit before interest, depreciation and tax (Ebitda) continued to decline from Rs 1,377 crore in SY 10 to Rs 356 crore in fiscal 14.

The road ahead

Shareholders who are expecting a turnaround in Shree Renuka Sugars' fortunes have more reasons to be cautious. Analysts say sugar prices will remain subdued both in India and abroad. Analysts at JM Financial say the Brazilian subsidiaries will continue to report losses because of low sugar prices in the global market and foreign exchange fluctuations. The company is raising funds by selling equity. Apart from selling a 27 per cent stake to Wilmar for Rs 500 crore, Shree Renuka Sugars is planning to raise up to Rs 750 crore through a rights issue. Analysts say this will not be enough to bring down its debt till the sugar cycle itself improves.

)