The profitability of telecom operators could take a hit on falling realisations of voice services. Although high data growth is expected to continue, three quarters of wireless revenues come from voice, where realisations are expected to fall by three per cent on a sequential basis for Bharti and Idea, denting margins by 50 basis points. Higher competition and discounts have meant that over the one-year period, average revenue per minute (ARPM) for both operators are down 8-12 per cent with Idea’s ARPM metric falling faster, according to analysts. There are other challenges for the operators.

Analysts at IIFL say the June 2015 quarter is expected to be a weak one due to higher service tax from June 1, reduced roaming fee cap from May, and lower interconnect usage charges for the full June quarter. While termination or interconnect charges have been reduced from 20 paise a minute to 14 paise a minute, roaming charges are down by 20-40 per cent for voice and 75 per cent for messaging services. Service tax, too, has been raised from 12.36 per cent to 14 per cent.

The bottom line is expected to be impacted for both Bharti and Idea due to elevated depreciation and interest costs after the launch of Bharti’s 4G services in Delhi, Mumbai and Tamil Nadu, while Idea launched 3G services in Delhi. While Idea’s net profit growth is likely to grow by three per cent sequentially, Bharti’s metric on this count is expected to fall by nine per cent largely due to the losses sustained in the African business.

While consolidated net profit for Bharti is expected to be Rs 1,141 crore, for the company’s African business the loss is pegged at Rs 1,192 crore. Given the cross-currency issues, revenues in the African business are expected to dip four per cent in dollar terms given the weak Tanzanian, Zambian and Nigerian currency, say analysts at Religare Institutional Research. Africa contributes 27 per cent to Bharti’s consolidated revenues.

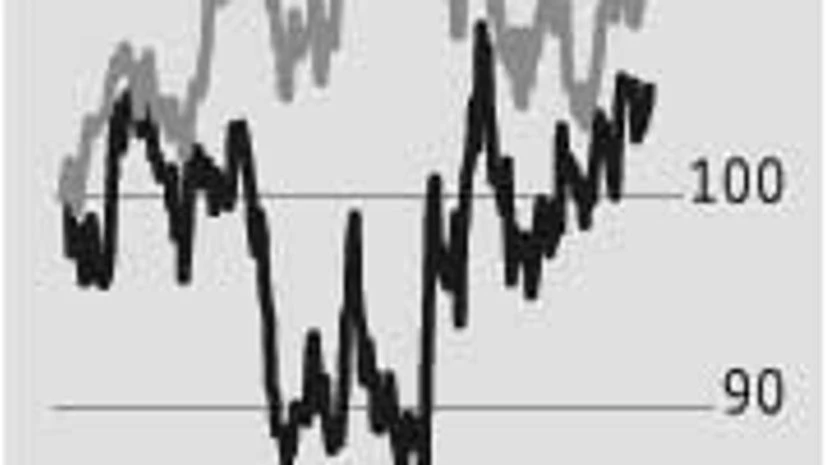

While there have been some gains in the telecom stocks, analysts are cautious given voice pricing pressures, capex programme and the upcoming launch of RJio.

)