Depressed rates in the real estate market have hit financially struggling Air India’s plans to monetise its assets. The government carrier has had to cut by 90 per cent the revenue it expects from the programme in the coming financial year.

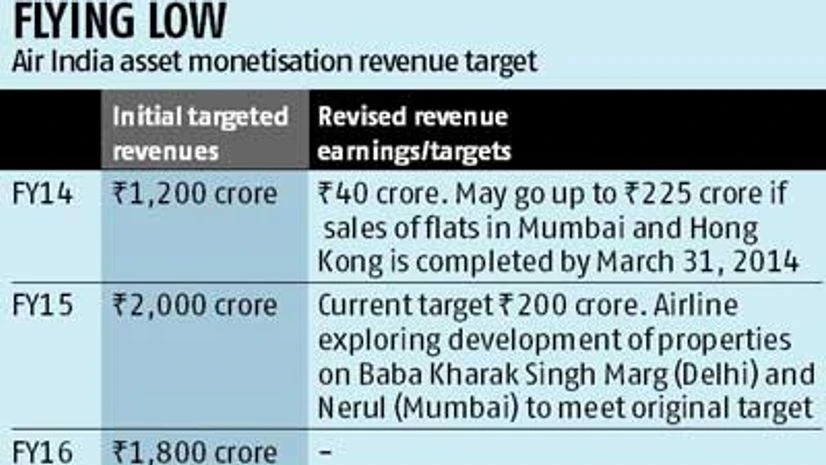

The airline had a three-year plan to monetise assets worth Rs 5,000 crore by March 2016 — to earn Rs 1,200 crore in FY14, Rs 2,000 crore in FY15 and Rs 1,800 crore in FY16 through this route. The decision was to use this money to retire its debt.

It is now aiming to gain only Rs 200 crore from sale and lease of properties in 2014-15, as compared to the earlier target of Rs 2,000 crore. It also appears in the current financial year (ending March 31), AI will be nowhere near its Rs 1,200-crore asset sales target.

A senior AI official told Business Standard, “We have been able to close deals worth Rs 40 crore this financial year, due to adverse market conditions and legal issues over title deeds and ownership clauses. There are some projects in the pipeline but given the current environment, for the next fiscal, too, revenues from asset monetisation programmes have been revised downwards, to around Rs 200 crore.”

This setback will adversely impact the plan to clear its debt, of Rs 30,000 crore on its books. Around Rs 25,000 crore is long-term debt; the rest is working capital debt. The financial restructuring plan aims to reduce the debt burden over nine years.

In the current financial year, 2013-14, the airline has been able to sell land parcels in Kolkata and Coimbatore for Rs 20 crore each. The deals are also yet to be cleared by the government.

Another AI official said, “There are procedural issues. Even if we close a deal, we have to send it to the ministry of civil aviation and then to the (Union) cabinet for clearance. So, it takes some time. We have received interest for our flats in Hong Kong and Mumbai, expected to fetch Rs 90-95 crore each. We are trying to close these deals in two to three weeks.” If the negotiations fructify and approvals come through before the end of this month, the airline would make around Rs 225 crore in asset sales in FY14.

AI did get an offer earlier from a private player to purchase its four properties in Sterling Apartments, Mumbai, for Rs 23 crore each but the price was lower than the total of Rs 100 crore expected by the airline. AI is now in talks with State Bank of India (SBI) and Union Bank of India (UBI) for the sales.

On the sale of flats in Hong Kong, the process is on to transfer the properties to Air India Ltd from the erstwhile Air India, to meet the legal requirement for outright sale.

Once the transfer is complete, it might be able to close negotiations with SBI, UBI and Bank of India, all three of which have evinced interest in the properties.

That apart, the airline has put on hold the sale of land in Chennai (estimated to be worth Rs 120 crore), as advised by its real estate consultant, ETZ.

The second official added, “We were expecting to meet a large portion of the targeted revenues this fiscal from sale of land on Baba Kharak Singh Marg (in Delhi) but have not yet been able to get clearance from the (Union) ministry of urban development. We are pursuing the matter. Alternately, we are exploring possibilities to develop the land through a joint venture with a public sector unit like National Buildings Construction Corporation and lease out the property.”

The four-acre lot in question would have fetched it around Rs 800 crore.

AI has also opened talks with City and Industrial Development Corporation, Maharashtra, for development of a Rs 1,100-crore land lot at Nerul, Navi Mumbai. If both these projects move ahead, the airline might be able make Rs 1,900 crore in FY15, in line with its original target.

)