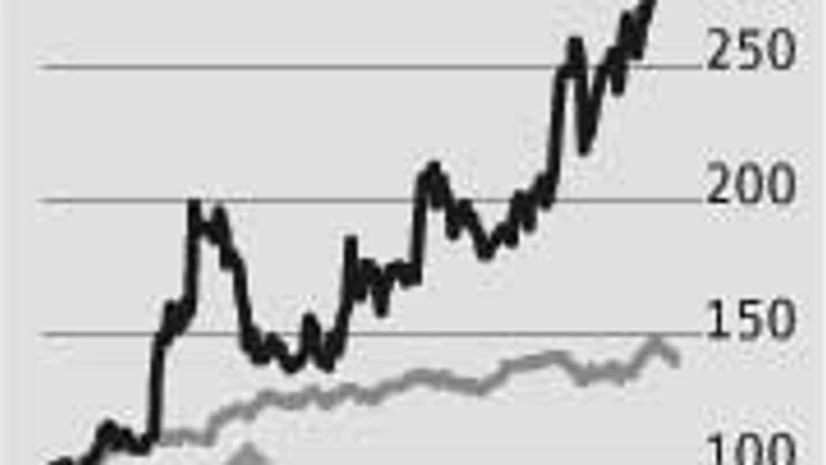

Wockhardt has proved a multi-bagger stock, growing more than threefold past year, after it had been dumped by investors post the import alerts issued by the US FDA (Food and Drug Administration). From a 52-week low of Rs 390.30 last February, the stock hit a 52-week high of Rs 1,332.80 on Monday, before closing at Rs 1,315.70. While the strong December quarter performance has encouraged investors, the prospects of getting FDA clearance and restarting exports to the US have increased. The Morton Grove facility in the US, inspected earlier by the FDA, has not seen any adverse action by the regulator, which has accepted Wockhardt's responses to their observations.

Also, its Chikalthana facility got clearance from the UK's Medicines and Healthcare Products Regulatory Agency (MHRA) to start supplying, raising the Street's hopes of the facility getting clearance from the FDA. The management during a conference call post results, said the company had offered all its manufacturing facilities to FDA for an inspection, including their new Shendra facility, in Aurangabad, apart from the Chikalthana and Waluj facilities that have faced the agency's earlier ire. The latter two were major growth drivers for the company before they stumbled on FDA.

Wockhardt launched 40 new products in India during FY15. In the US, it filed 13 Abbreviated New Drug Applications in the first nine months of FY15. The tally of pending approvals has gone up to 60. Some of these could be launch of an exclusive opportunity. Led by UK sales, Wockhard's December quarter sales were Rs 1,382 crore (up 12 per cent over a year), 42 per cent ahead of the Bloomberg consensus estimate of Rs 976 crore. Earnings before interest, taxes, depreciation, and amortisation were Rs 463 crore, almost double the year-ago figure of Rs 241 crore and was ahead of the estimate of Rs 96 crore. Thus, net profit at Rs 347 crore was much ahead of the consensus estimate of Rs 42.3 crore.

Looking at the developments, analysts at Citi, building in a 50 per cent probability of full resolution of issues, say resolution at Morton Grove is positive and some progress with MHRA on Chikalthana has likely been made. “Timing a full recovery is hard and thus we use a probability approach to set our target price of Rs 1,880, from Rs 1,010 earlier.”

)