Vedanta Ltd, formerly Sesa Sterlite, is set to make an official announcement on Sunday about its merger with wholly owned subsidiary Cairn India.

“The official merger announcement will take place in Mumbai on Sunday,” a source close to the development told Business Standard.

ALSO READ: Vedanta needs to improve balance sheet to maintain rating: Moody's

The source added that a two-day executive committee meeting would now be held in Mumbai, instead of New Delhi, the venue decided earlier. The boards of the two companies would meet on Sunday and a formal announcement would be made later in the day, the source confirmed.

In a statement disclosing the possibility of the merger, Vedanta informed the London Stock Exchange that it would maintain its London listing in case such a transaction took place. “Should a transaction with Cairn India Ltd proceed, it could potentially be considered a reverse takeover,” Vedanta said in the statement.

ALSO READ: Vedanta's Cairn India impairment credit negative: Moody's

“In addition, in line with the stated strategy to continue to simplify its structure, the group continues to evaluate a transaction with the Government of India in relation to its minority stakes in Hindustan Zinc and Bharat Aluminium Company,” it added, referring to two other subsidiaries in which the government holds large stakes.

The London-listed parent has a majority stake in Vedanta Resources, which in turn holds a controlling stake in Cairn.

According to analysts, the deal will give Vedanta access to Cairn India’s cash and investments worth Rs 16,000 crore.

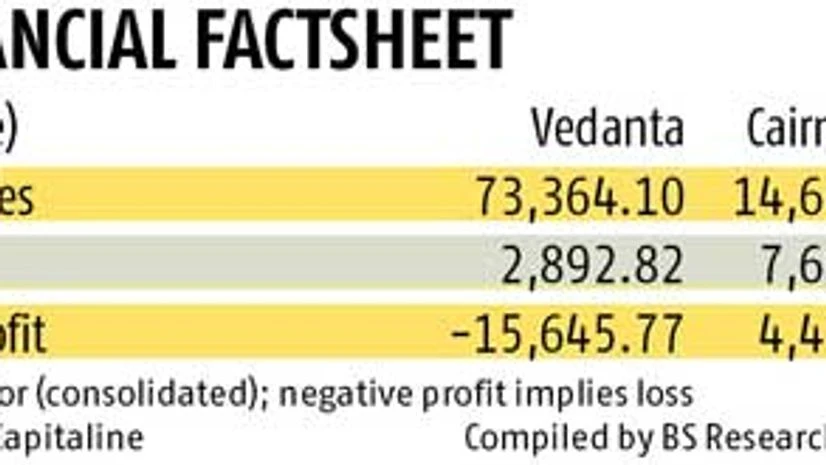

The merger is also expected to help Vedanta become a global major and compete with companies like Rio Tinto and BHP Billiton. In the year ended March 2015, Vedanta and Cairn India had taken a hit on their bottom lines due to the impairment charges the oil company had to bear on account of falling crude oil prices.

In January, Vedanta Chairman Anil Agarwal had said the company was exploring options to merge cash cows Cairn India and Hindustan Zinc with itself. Shares of Cairn India on Wednesday ended seven per cent higher than their previous close, at Rs 184.80 apiece, while those of Vedanta rose 1.26 per cent to Rs 184.85.

But the merger, talks for which have been on for some time, has not gone down well with Cairn India investors; they fear the company’s cash will now be more accessible to debt-ridden Vedanta, which holds a 59.88 per cent stake in the former. As on March 31, the standalone debt of Vedanta after excluding liabilities of its subsidiaries stood at Rs 37,636 crore, compared with Cairn India’s cash and cash equivalents of Rs 16,000 crore.

Another reason for a disappointment among Cairn investors could be the timing of the merger — the share price of the oil major has halved over the past year along with oil prices. For Vedanta, it is a ripe opportunity to go ahead with the deal.

)