As crude oil continues its slide, Asian refining margins stand near a two-year peak. But in this rally, private players in the country are gaining the most against their public sector counterparts.

After three years of stability, crude oil prices have seen a drop of over 50 per cent in the last one year. That should have meant better refining margins for refiners. But state-run Indian Oil Corporation (IOCL), Bharat Petroleum Corporation (BPCL) and Hindustan Petroleum Corporation (HPCL) have in the past financial year reported refining margins in single digits against the double digits reported by Reliance Industries and Essar Oil.

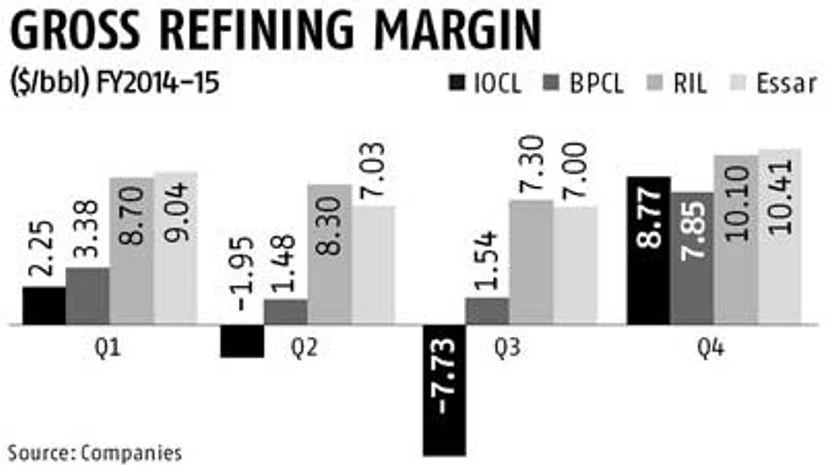

In fact, IOCL, the largest public sector refiner, saw its refining margin slip into the negative for the first time. Gross refining margins (GRMs) are the difference between buying of crude and average selling price of refined products.

Consider this: While FY15 first quarter GRM for RIL stood at $8.7 per barrel, Essar Oil stood at $9.04, that of IOCL, BPCL and HPCL stood at $2.25 per barrel, $3.38 per barrel and $2.04 per barrel, respectively (see table).

Low GRMs were also on account of high inventory losses for the oil marketing companies. According to Nomura Research, total inventory losses for IOCL stood at Rs 17,800 crore; for BPCL it was at Rs 7,370 crore, and for HPCL it was at Rs 5,030 crore in FY15. This included refining and marketing inventory losses.

A key reason for high GRMs of private players is the variety of crude they can process, based on their refinery’s complexity. A complex refinery is one with an ability to process heavy or very low quality crude that can be sourced cheaper than light or good quality crude and be processed into fuel.

After three years of stability, crude oil prices have seen a drop of over 50 per cent in the last one year. That should have meant better refining margins for refiners. But state-run Indian Oil Corporation (IOCL), Bharat Petroleum Corporation (BPCL) and Hindustan Petroleum Corporation (HPCL) have in the past financial year reported refining margins in single digits against the double digits reported by Reliance Industries and Essar Oil.

In fact, IOCL, the largest public sector refiner, saw its refining margin slip into the negative for the first time. Gross refining margins (GRMs) are the difference between buying of crude and average selling price of refined products.

Consider this: While FY15 first quarter GRM for RIL stood at $8.7 per barrel, Essar Oil stood at $9.04, that of IOCL, BPCL and HPCL stood at $2.25 per barrel, $3.38 per barrel and $2.04 per barrel, respectively (see table).

Low GRMs were also on account of high inventory losses for the oil marketing companies. According to Nomura Research, total inventory losses for IOCL stood at Rs 17,800 crore; for BPCL it was at Rs 7,370 crore, and for HPCL it was at Rs 5,030 crore in FY15. This included refining and marketing inventory losses.

A key reason for high GRMs of private players is the variety of crude they can process, based on their refinery’s complexity. A complex refinery is one with an ability to process heavy or very low quality crude that can be sourced cheaper than light or good quality crude and be processed into fuel.

Refiners who are able to do this rake in better refining margins as they buy low and sell the refined products at international benchmark prices.

Officials at the OMCs say that 90 per cent of these refineries are old and less energy-efficient, which makes a big difference to their operational metrics.

The complexity of refineries is measured in terms of Nelson Complexity Index (NCI). Refineries with a Nelson complexity of 10 or above are considered a complex refinery.

RIL, which runs the world’s biggest single-location refinery, currently has an average complexity of 12.6, while BPCL’s Bina refinery has close to 10 and HPCL’s Bathinda unit has a complexity of 12. Essar Oil’s refinery’s complexity is 11.8. Due to the complexity of their refineries, private players are able to process crude, which is cheaper.

“A big reason for healthy GRMs of private refiners is that they have state-of-the-art refineries where they are able to convert the last ounce of crude into finished product. Private players can extract 90 per cent distillate product,” said R K Singh, ex-chairman and managing director, Bharat Petroleum Corporation Limited.

Though IOCL’s total refining complexity is 9.6, its latest refinery at Paradip, once completed, will be the most modern with complexity factor of 12.2, making it capable of processing cheaper, higher sulphur and heavy crude.

The benchmark is usually the Singapore gross refining margins, which are the average gross refining margin of major Asian refiners. RIL says traditionally, its refineries have enjoyed $3-4 per barrel premium over Singapore GRMs.

Location and crude sourcing

The refineries of RIL and Essar are located on the coast, while that of PSUs are land-locked. IOCL has to transfer its crude to different locations, which are land-locked. So the cost goes up impacting the realisations.

On the sourcing front, private players have a pricing advantage. Public sector companies buy from national oil companies through tenders, while private players can source crude from players who give them a good deal, including spot purchases. “Public sector refiners have to buy through a tendering process. They usually go for an official selling price for a one-year contract and cannot negotiate one-on-one. The discounts and premium offered by sellers have to be forgone by the public sector refiners,” said the refining director of a public sector refinery.

Since late 2014, Saudi Arabia lowered its official selling price to Asia and has been selling at a discount to the Dubai benchmark reference, something not seen in four years.

“International Energy Agency states that other suppliers in Kuwait, Qatar, UAE and Iran also follow this strategy,” said Nomura Research.

Asian refineries, which are large consumers of Middle Eastern oil, have enjoyed price discounts in recent months. “On average, crude oil imports into OECD (Organization for Economic Cooperation and Development) Asia were at $5 per barrel, lower than for European OECD countries in February, according to International Energy Agency.

This was the largest discount since March 2011, in contrast with 2014’s average premium of $3-4 per barrel,” added Nomura Research.

Besides, with private players having their petrochemical plants in the refining complex, it becomes defining.

“Players like Reliance Industries can alter their production slate and pattern as per the changing market conditions. Whereas, for public players, we have to adhere to the marketing department’s directions,” said the director, refineries, of an OMC.

Also, RIL and Essar Oil have huge tanks and storing facilities to import and blend crude. That facility is not available with public sector refiners.

According to RIL, “Narrowing of sweet-sour crude differentials provide an edge to RIL to suitably alter the sourcing strategy to increase the crudes priced on sweet benchmarks.”

However, going forward, analysts are positive that GRMs of the oil marketing companies will show an improvement.

Regional Singapore complex margins have been very strong in the past few months. First quarter average GRMs of $8.4 per barrel were up 35 per cent year-on-year (Y-o-Y) and 34 per cent quarter-on-quarter (Q-o-Q). And, even the GRMs in first quarter of FY16 $8.1 per barrel remained strong.

)