Faster growth in rural markets for the segment has prompted some major fast-moving consumer goods (FMCG) players to bet on this market over urban areas.

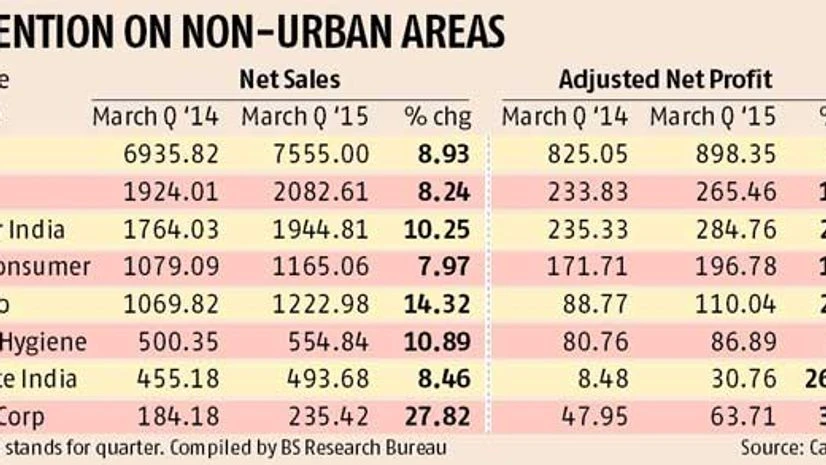

The first set of fourth quarter (Q4) results for the financial year 2014-15 declared by some of these companies reveals some of the big names are betting on villages. Hindustan Unilever (HUL), Bajaj Corp and Godrej Consumer Products (GCPL) seem to be betting on rural; Marico and Dabur are counting on urban. Their numbers support their claims.

HUL managing director and chief executive officer Sanjiv Mehta said his firm’s rural growth was ahead of urban for the quarter. This trend, he said, was visible for the overall market as well. “If you look at a one-year period, urban growth for FMCG has been four per cent, while rural growth has been eight per cent.”

While Mehta avoided making projections, analysts say HUL could keep its rural bet going for at least the next few quarters, despite an urban recovery expected closer to FY17. “Which means companies with a rural bet have a better chance of succeeding, since growth rates are higher there,” said Nitin Mathur and Vivek Veda, research analysts at Societe Generale.

As the threat of a long dry spell impacting farm incomes, analysts and companies such as HUL and GCPL claim it is too early to look the other way.

“While urban sales in the past three quarters have grown faster than rural in the home and personal care category, rural (sales) growth is still ahead of urban by 600-800 basis points in this period. My sense is it will stay like this for some time. If that is the case why should I take my attention off the rural map?” GCPL’s managing director Vivek Gambhir said.

Dabur, on the other hand, said urban growth recovered in Q4, aided by growth in organised retail. But rural growth wasn’t slowing.

While Dabur CEO Sunil Duggal has said his company will look at making more investments in urban areas, analysts say it is not likely to switch attention away from rural areas, given that growth in the hinterlands hasn’t slowed for it yet. Dabur derives over 40-45 per cent of its domestic revenues from rural areas. HUL’s is 45 per cent, while most other firms are in the 30-35 per cent bracket.

)