While announcing its fourth quarter results last week, Crompton Greaves said it would sell the foreign power business. Another example of how fortunes change drastically in an uncertain environment - these overseas acquisitions were once treated as crown jewels.

The power systems business was till a few years earlier among the most profitable for the company. Under former managing director S M Trehan, the first bold move was made in 2005 to expand outside India, with the acquisition of Pauwels, a Belgian transformer manufacturer. Seven more followed, in Hungary, Ireland, France, the US and Sweden. From a loss-making entity in 2000, Crompton began making profits.

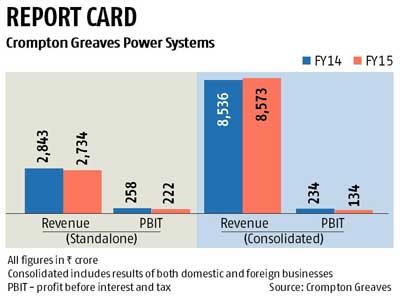

A slowdown in 2011-12 changed the situation. The foreign subsidiaries have suffered losses from 2012, though the domestic business continues to make profits. Crompton's business is spread in three segments -- power systems, industrial systems and consumer products. Power systems is the largest of the three, contributing 60 per cent of total revenue. The company earns 55 per cent of revenue from domestic operations.

Earnings before interest, tax depreciation and amortisation (Ebitda) of the foreign power systems business fell from Rs 456 crore in 2010-11 to Rs 90 crore in 2013-14. The losses continued in 2014-15, the overseas power business systems segment reporting a loss (before interest and tax) of Rs 88 crore, up from one of Rs 24 crore the previous year.

Also, the share of the power systems division in consolidated revenue (which includes income from domestic business) fell from around 70 per cent in 2008-09 to around 60 per cent in 2014-15. The segment's share in consolidated profit before interest and tax was down from 60 per cent to 21 per cent in the period.

What went wrong? A slowing transmission and distribution business, with intense competition, customer-end delays and production-related problems in the power systems plants in Canada and Hungary led to the foreign business posting a loss from 2012 on.

The company tried to stem the losses. It restructured its European business and shifted operations from Belgium to Hungary and tried to restructure the Canadian power transformer plant. It all proved insufficient and, stung by the continuing losses, it decided to exit the overseas power systems business.

Crompton said it had received non-binding proposals for acquisition of the power business in Indonesia, Europe, the US and Canada, and for its transportation automation business in the US. "These offers constitute a firm indication of interest but are subject to due-diligence, negotiation and execution of definitive agreements. These are in line with the board's strategic intent of focusing on its profitable India businesses and global automation business. The board has reviewed the offers and has constituted a committee of directors to take next steps," Crompton said in a filing to stock exchange last week.

Analysts are impressed with the "practical" approach shown by the company. "We believe this deal (proposed sale of power business) could be a positive for Crompton Greaves if it goes through, as the international business has been bleeding for the past few years and the company has been unsuccessful in turning it around," said brokerage firm Prabhudas Lilladher in a post-results analysis report.

"Crompton wants to exit these (presently unprofitable) businesses and focus on the profitable domestic B2B (business to business segments). On the technology front, it is less reliant on these subsidiaries after having indigenised 765 Kv transformer technology in India. On the GIS front, it may lose out or look for a partner to grow the business. We think it might, post this deal, look for a technology partner for its India B2B business or even sell it at an appropriate valuation, which has many (Chinese and Korean companies)," Kotak Securities wrote in a report.

)