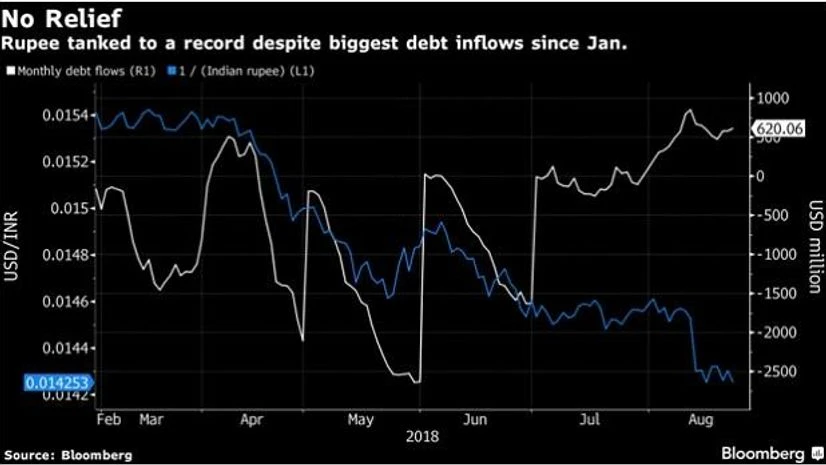

Global investors in August bought the most Indian bonds in seven months, showing signs of returning to a market they’d abandoned for the better part of 2018. The inflow brought no joy for currency traders as the rupee hit multiple new lows in the past two weeks.

Funds plowed $403 million into rupee-denominated bonds after $105 million in July, amid optimism the worst of the yearlong rout that sent the local benchmark yield to its highest since 2014 is over. The streak needs to extend to chip away at this year’s outflow of $5.6 billion that has contributed to the currency

)