The government is likely to unveil the much-awaited annual supplement to the Foreign Trade Policy (FTP) 2009-2014 on April 15.

The focus this time will be on sectors constituting part of the bulk of India's merchandise shipments such as engineering, gems and jewellery and textiles, besides leather. In his Budget speech, Finance Minister P Chidambaram had said, “I look forward to the changes that will be made to the FTP. I assure my support to measures that will be taken to boost exports.”

This has unleashed a sense of urgency in the commerce ministry, which was earlier thinking of issuing the supplement a little later in the year, said people in the know of the development. The supplement was announced in June last year, with more measures to boost exports in December. The annual supplement this year might extend a two per cent interest subvention to engineering, gems and jewellery and leather, officials in the commerce department told Business Standard.

During April-January of the current financial year, export of engineering products, gems and jewellery and textiles declined by four per cent, 10 per cent and eight per cent, respectively, due to the massive slowing of demand in the American and European markets.

The government might give a major thrust to units inside Special Economic Zones (SEZ). These already have 100 per cent income tax exemption for the first five years of operations. The zones have faced rough weather since the government imposed a Minimum Alternate Tax (MAT) and Dividend Distribution Tax (DDT) in the 2011-12 Budget, the former on the units and both taxes on SEZ developers. Of the 588 SEZs formally approved, 385 have been notified but only 161 are operational.

In the current policy framework, SEZs no longer provide a lucrative offer for unit holders or developers to continue investing in these,” said Adi Godrej, chairman of the Godrej Group and president of the Confederation of Indian Industry. He hoped the government would provide a policy impetus by considering the demand for abolition of both MAT and DDT.

The focus this time will be on sectors constituting part of the bulk of India's merchandise shipments such as engineering, gems and jewellery and textiles, besides leather. In his Budget speech, Finance Minister P Chidambaram had said, “I look forward to the changes that will be made to the FTP. I assure my support to measures that will be taken to boost exports.”

This has unleashed a sense of urgency in the commerce ministry, which was earlier thinking of issuing the supplement a little later in the year, said people in the know of the development. The supplement was announced in June last year, with more measures to boost exports in December. The annual supplement this year might extend a two per cent interest subvention to engineering, gems and jewellery and leather, officials in the commerce department told Business Standard.

During April-January of the current financial year, export of engineering products, gems and jewellery and textiles declined by four per cent, 10 per cent and eight per cent, respectively, due to the massive slowing of demand in the American and European markets.

The government might give a major thrust to units inside Special Economic Zones (SEZ). These already have 100 per cent income tax exemption for the first five years of operations. The zones have faced rough weather since the government imposed a Minimum Alternate Tax (MAT) and Dividend Distribution Tax (DDT) in the 2011-12 Budget, the former on the units and both taxes on SEZ developers. Of the 588 SEZs formally approved, 385 have been notified but only 161 are operational.

In the current policy framework, SEZs no longer provide a lucrative offer for unit holders or developers to continue investing in these,” said Adi Godrej, chairman of the Godrej Group and president of the Confederation of Indian Industry. He hoped the government would provide a policy impetus by considering the demand for abolition of both MAT and DDT.

As a long-term measure, the government is expected to propose the creation of an Export Development Fund, an incentive for exporters to venture into newer markets. As mentioned earlier, demand in the traditional markets of the US and Europe have seen a sharp decline and is not expected to rise in the near future.

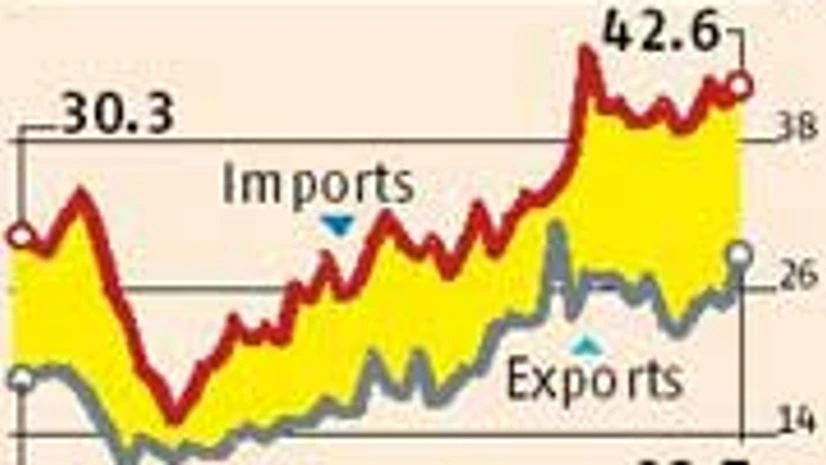

During the first 10 months of the financial year through January, merchandise exports declined 4.9 per cent year-on-year, to $240 bn from $252 bn. It started declining since May; in January, though, the fall was less than one per cent. Whether exports will look up further will be known tomorrow, when the commerce ministry issues trade data for February.

This year, the main challenge will be to retain last year’s export growth. It is time the government reduces the cost of credit if it really wants to give a boost to the sector, says Ajai Sahai, director-general, Federation of Indian Export Organisations.

According to a recent study by Assocham, plummeting exports have resulted in the loss of about a million jobs across labour-oriented sectors such as leather, apparel, gems and jewellery.

Sharma has held a series of consultations with CII and the Federation of Indian Chambers of Commerce and Industry. Both chambers have urged the government to ensure more export credit in general and refund of state levies.

The trade deficit had surged to $167 bn in April-January, 7.9 per cent higher compared to $155 bn in the corresponding period of 2011-12. Chidambaram had said in the Budget speech that this was more worrying than the Centre’s fiscal deficit.

)