For the first time, India has overtaken China in net addition of mobile subscribers in the January-March quarter this calendar year, shows the biannual Ericsson Mobility Report on global usage of mobile phones.

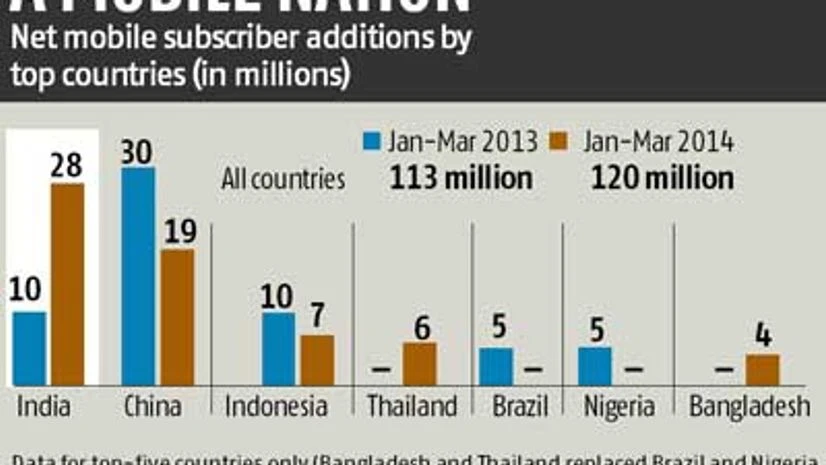

During the three-month period, India added 28 million mobile users, while China’s subscriber base swelled by 19 million. This was unlike the past few quarters, when China consistently topped the net-addition chart.

India and China were followed on the list by Indonesia (seven million additions), Thailand (six million) and Bangladesh (four million). More than half the 120 million new mobile subscribers during the quarter globally were from these five Asian countries.

During the same quarter last year, China had accounted for 30 million of the 130 million new subscribers globally, while India’s net addition had stood at 10 million.

The previous edition of the Ericsson report had shown that 30 million of the world’s 113 million user additions were in China in the third quarter of 2013, while India had stood second with 10 million net additions.

The numbers clearly reflect Asia’s dominance in the growth of mobile telephony, even as there remains a substantial gap between India and China in the total subscriber base. This gap has, in fact, increased in the past year.

In the first quarter of 2014, India had 790 million mobile subscribers, compared with China’s 1.25 billion — a difference of 460 million. This gap was lower at 431 million in the same quarter of last year, when China had 1.15 billion users, while India had 716 million.

The good news, however, is that India’s share in the number of mobile users globally is rising — the country accounted for 11.61 per cent of the world’s 6.8 billion users in the first quarter of 2014, compared with 11.09 per cent in the same quarter of 2013.

Experts also say that India will now grow faster than China in net additions, as the latter’s market is saturating, with a high level of penetration after the government’s efforts in rural parts.

Explaining the growth, Cellular Operators Association of India Director-General Rajan Mathews says: “Unlike in China, where the overall penetration has reached a peak, there is a huge growth possibility in India (with only 46 per cent rural penetration). Of the five-six million customers added every month in India, at least 30 per cent are from rural parts. Armed with newly acquired spectrum, telcos are increasingly concentrating on the untapped rural market. If they have to meet the rollout obligations for 3G and 4G services, they must increase their rural penetration.”

This is also reflected in the Mobility report, which says mobile phone penetration in the first quarter of 2014 was at 63 per cent in India, compared with 90 per cent in China, where the focus now was on increasing average revenues through aggressive data rollouts.

North America is the only region apart from Asia that has seen growth in user base when compared with the same quarter of last year. Africa, which is seen as a fast-growth market and where Bharti Airtel is also present, added fewer subscribers in the first quarter of 2014 than in the year-ago period.

)