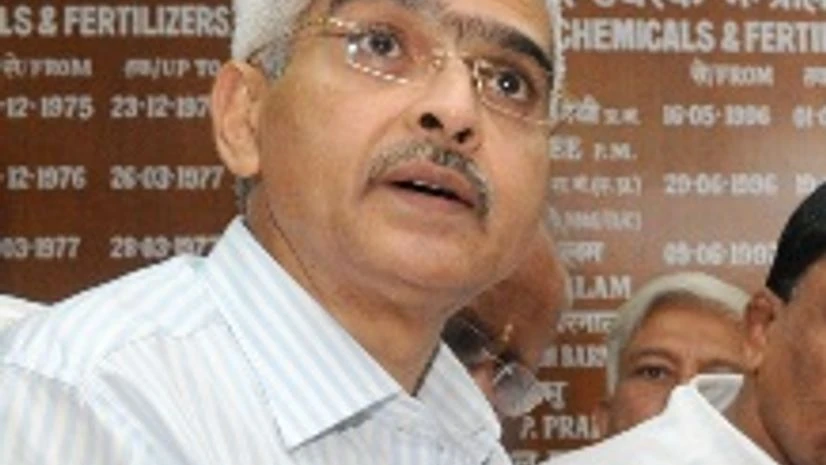

Union Revenue Secretary Shaktikanta Das has held a number of posts in the finance ministry at various times since 1984. Now, after a Budget which saw many big announcements on taxes, he has to ensure the revenue department turns around its record of not meeting budgeted targets for the past five financial years. Edited excerpts of an interaction with Jayshree P Upadhyay & Arup Roychoudhury:

The combined direct and indirect revenues budgeted for 2015-16 are Rs 9.2 lakh-crore. Since 2009-10, the revenue department has consistently fallen short of its targets. How do you expect to turn that around this time?

The targets are very realistic. Under direct tax, the 2014-15 revised estimates represent a growth of 10.5 per cent over 2013-14 actual collections. The growth between the budgeted estimates for the next financial year and revised estimates this year is about 2.5 per cent, very achievable, as a certain level of growth in gross domestic product (GDP) has been assumed.

More From This Section

Then, the diesel and petrol duty rise, which we started in November; we will have the impact of all four rounds of increase for 2015-16. Fourth, from January 1, we have withdrawn the duty cut on automobiles and capital goods. Next year, we will get the full impact. Taking into account all these factors, the increase of 19.5 per cent is achievable. It is a very credible number.

Two of the biggest takeaways in this Budget were the proposed reduction in corporate tax and increase in service tax. Over four years, the corporate tax exemptions will be phased out. Will that make Minimum Alternate Tax redundant? How soon will we see these exemptions getting withdrawn?

MAT will stay, as the MAT rate is 18.5 per cent. If you add cess, it is a little less than 20 per cent. We are looking at a corporate tax rate of 25 per cent. So, there is still a five-six per cent gap.

On removal of exemptions, the government will announce a road map. The reduction of corporate tax rates and elimination of exemptions will move in tandem. We propose to finalise and announce this during the current year. But the tax rate reduction will be announced only in the next Budget. It is work in progress. There is no final say on whether some exemptions will stay.

What was behind the intent to reducing corporate tax?

We want India to be a competitive investment destination and attract more investment, to provide jobs for youth. We want more investment, more jobs and more economic activity. You will get more investment only when your environment is competitive.

There are two aspects to it. The first is the regulatory environment, wherein the government is providing ease of doing business to manufacturing and services. The second aspect is the taxation regime. When you look at our corporate tax rates, they are higher compared to other big Asian economies like China, Malaysia, South Korea, Thailand, Indonesia, etc. All these countries have a corporate tax rate of 25 per cent or less. If I am a big investor looking to invest in Asia, this is a critical component in my decision making. We have to be competitive.

By lowering the corporate tax to 25 per cent, you are also leaving more resources with companies. This decision is also to enable our companies to invest more and create more jobs, to spur economic growth.

Coming to GST. You have yet to get the constitutional amendments passed in Parliament. Even after that, the legislative process is quite lengthy. Are you confident of meeting the April 1, 2016 deadline for GST rollout?

Work is in progress very silently. We have several sub-committees and committees, consisting of representatives of revenue department and the CBEC (Central Board of Excise and Customs) and state finance and tax departments. They are working on drafting the Central, State, and Inter-State GST legislations, rules and processes. Work is going on various fronts, and in this budget session, it will be our sincere effort to pass the constitutional amendment bill. If there is broad consensus, there is no reason why it should not be passed. I think everybody realizes that it is necessary, and GST has now gone above politics.

There is a criticism here. On one side are the states. On the other is the industry. When will you interact with the industry on this? The apprehension is that it will suddenly find itself in this new GST regime on April 1, 2016 without being prepared for it.

The concern of the industry is very genuine, and if they feel that they need to know more, we will ensure greater interaction and share more information. It is not correct to say that there has been no sharing of information. We have held seminars and symposiums in every state. The process of consultation is very much there. If there is a feeling that we need to do more, we will do more. We are in consultation and dialogue with industry and trade. If there is a feeling that it isn’t enough, I take that point in a positive sense. We will hold more interactions with industry.

During the Budget exercise, we saw a number of taxes being introduced by way of cess and surcharge. These remain out of the divisible pool. How much is the Centre is likely to garner by way of these taxes?

The excise on petrol and diesel is likely to garner Rs 40,000 crore that we are charging by way of road cess. The amount goes to roads, National Highways Authority of India and the railways. The government wants to give the most to roads, railways and infrastructure. As far as the surcharge, the whole philosophy of the Budget is that those who can afford more should pay more, which is why surcharge is being imposed on these entities. This is likely to fetch the government close to Rs 9,000 crore.

As far as the Swachh Bharat cess is concerned, it is an enabling provision. There are three aspects to it. It can be less than two per cent, the Bill says it is to be implemented from a date yet to be notified and yet to be worked and, finally, it says it would be implemented only if need be. It is not as if overnight all services will see a levy of Swachh Bharat; some select services will see the levy.

The Direct Tax Code recommendation was to remove all exemptions the budget saw the implementation for corporate tax. Would something similar happen for personal tax?

No, one thing is very clear that the government plans to give more to the middle class. And currently the question is of affordability as and when the condition of fiscal improves the middle can expect more. Therefore, the exemptions for personal tax are there to say because they in turn lead to savings and more investments.

What recommendations of the Tax Administrative Reforms Commission (TARC) are likely to be accepted and by when?

The recommendations are in advanced stages of examination and they will be appropriately implemented during the course of the year. We have not yet taken a view on the merger of CBEC (indirect tax) and CBDT (direct tax). We have had several consultations on the recommendations by the committees that were set up by us to study the administrative impact of these measures. The committees have completed their work and have given their reports and the boards are now looking at them.

The General anti avoidance rule (GAAR) got deferred by another two years and the government also ensured that it will imposed only prospectively, then what was the need to defer it to 2017?

There is a positive investment sentiment in the country now and we want to maintain that, there were some contentious issues raised by the industry that we are trying to iron out currently. But, GAAR will be imposed from April 2017 and one should not assume that it will be deferred indefinitely. The government took a proactive decision of imposing it only prospectively.

Talking about section 9, which is for Vodafone like cases, that have been taken care of. But, what about retrospectivity, why not repeal it?

Retrospective taxation is a dead issue no one is talking about it. The issue was addressed amply in the previous budget speech where it was stated that government will not ordinarily seek fresh tax liability on old transactions. There are about 35-36 cases that are under some litigations after being hit by the retrospective amendment, other than that no cases that I can think of.

Section 9 of the income tax act contained several ambiguities that have now been completely cleaned up like substantial asset definition. Now it is no longer left to the discretion of the tax official that what is the substantial value the company is deriving from India, now we are saying it is 50% of assets, in line with recommendation of Shome committee and judiciary.

Could you let us know that whether any new MAP and APA agreements are in offing with other countries after signing it with US?

I would not like to talk about any specific agreements until it is concluded but US was a huge achievement which was hugely appreciated by the US treasury Secretary and our finance minister. This initiative was pending for the last 2-3 years.

The black money bill and Benami act that is likely to be introduced in the budget session. Could you throw some light on it as to what it proposes to achieve?

The rules under the Benami act were never implemented and the bill lapsed in 2009. With the new bill we are bringing about a more comprehensive piece of legislation. The IT act needed improvement to track the black money or assets that are stashed abroad which we have done now and now the law it much more strong. If we find some money stashed aboard the bill gives us the power to attach assets of the same value in India under the money laundering act. Huge deterrent is also there on concealment of assets in terms of rigorous imprisonment provision and penalty at the highest marginal rate. The one time compliance opportunity is not an amnesty scheme because you will be required to pay penalty. People who come clean will be saved from prosecution. The government’s intent is to get the bill passed in this session itself.

)