In a daring assault on India’s black economy, Prime Minister Narendra Modi announced demonetisation of existing Rs 500 and Rs 1,000 currency notes last week. While there is no sure measure of the black economy, Chart 1 details different studies and reports that have attempted an estimate — starting from the calculations of noted economist O P Chopra to those of D K Rangnekar. For the most part, far from the often-rumoured estimates upwards of 100 per cent, the reports centred around 20 to 25 per cent.

Chart 2 shows why the prime minister chose to demonetise Rs 500 and Rs 1,000: The two denominations accounted for 86 per cent of all currency notes. Scrapping and replacing these with new ones would largely take care of all the black money stored in the form of cash.

Chart 3 shows the impact of demonetisation on different economic variables over the short, medium and long term. While gross domestic product (GDP) and currency in circulation will be hurt as an immediate consequence, in the long term, most variables will benefit.

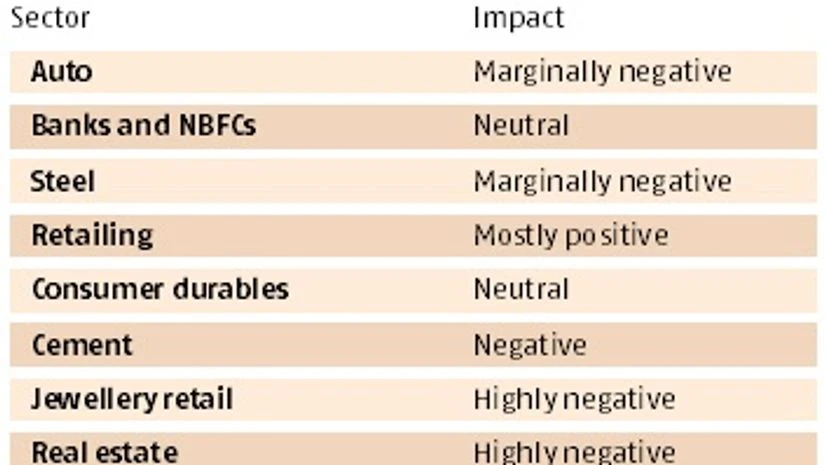

Chart 4 looks at the immediate impact on different sectors of the economy. Retailing will mostly gain but, not surprisingly, real estate and retail jewellery – two sectors that attract a significant amount of black money – will be affected adversely. For real estate, in particular, this could be bad news. As Chart 5 shows, because of the economic slowdown, house prices have been moderating. Demonetisation is expected to result in a 20-25 per cent cut in prices.

ALSO READ: Here's how PM Modi plans to hunt down benami property holders

A fair amount of India’s black money is stashed outside the country as well. Chart 6 shows the cumulative figures for illegal outflows between 2004 and 2013, and India ranks among the top five countries of the world in this, according to the Global Financial Integrity report.

READ OUR FULL COVERAGE

)