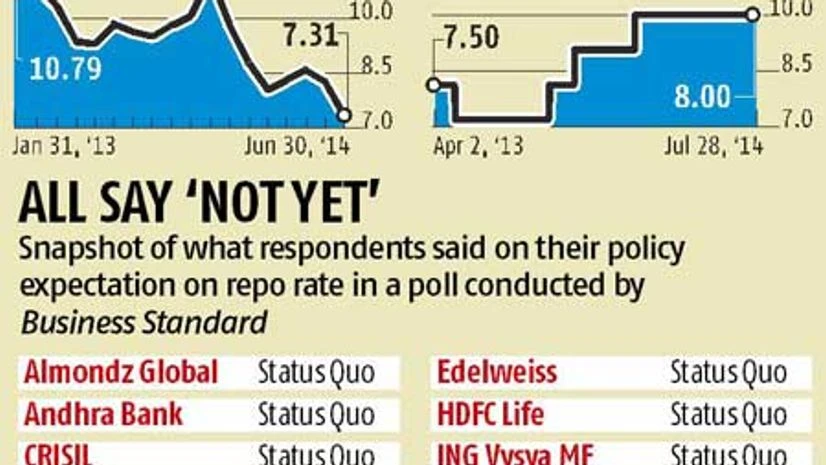

Despite the consumer price index-based inflation rate having fallen to its lowest level since the launch of the new series in January 2011, the Reserve Bank of India (RBI) is likely to go for the status quo on repo rate in its monetary policy review on August 5, shows a poll conducted by Business Standard among 10 market participants.

The respondents to the BS poll unanimously said they expected the status quo. Amid an uncertainty over monsoon, if the central bank keeps the repo rate - the rate at which RBI lends to banks; currently at eight per cent - unchanged, it will be a third straight policy review in which it will do so. The reverse repo rate is seven per cent at present.

The retail inflation rate had stood at 7.3 per cent in June, compared with 8.28 per cent the previous month. The current level is under RBI's January-end projection of eight per cent, though above its comfort level. Monsoon, too, has improved lately, with the rainfall deficiency narrowing to 25 per cent until last week from 43 per cent at the end of June.

However, despite an improvement in these two key parameters, experts believe it might be too early for RBI to reduce rates. "The decline in headline inflation in Q1 was higher than expected. Even the core inflation rate has started declining. But August might be too early to consider a rate cut. The disinflation process has only just started and will need time before inflation drops to a sustainable level," Standard Chartered Bank economists Anubhuti Sahay and Samiran Chakraborty said in a note to clients.

In the five policy review since taking charge as RBI governor in September last year, Raghuram Rajan has raised the repo rate by a total of 75 basis points in the first three and kept it unchanged in the two to follow. The recent softening of inflation has largely been on account of a high base, so there are fears this might vanish in the later part of the current year. Therefore, the central bank might choose to be cautious in tinkering with rates.

Though no action is expected on the rate front, the central bank's indication of the policy path for the new few months will be crucial. It might open the possibility of reversing the rate cycle later. During the previous policy review, RBI had said a higher-than-expected drop in inflation rate could lead to a reduction in interest rates.

"In our new forecast, headline CPI-based inflation stays below eight per cent for the rest of 2014-15. This supports hopes of a rate cut later in the year," said the Standard Chartered Bank note.

The new government's resolve to bring down its fiscal deficit to 4.1 per cent by March and efforts to ease supply-side bottlenecks could act as a further trigger for softer interest rate regime.

Some said RBI might look at even other aspects, such as the savings rate and its trajectory, before effecting a rate cut. "The wholesale price index (WPI) -based core inflation rate is moving up. WPI core, which is a reflection of the manufacturing and production sector, is significant," said Kotak Mahindra Bank Chief Economist Indranil Pan, adding RBI might carefully monitor the implications of a weak monsoon on inflation.

)