Despite the positive sentiment in the domestic market due to the current account deficit narrowing and the fact that the primary Opposition party is likely to win state Assembly elections, it is felt the rupee will not appreciate from current levels till the year-end. This is primarily because it is likely concern that the US Federal Reserve may taper its bond-buying programme may resurface due to encouraging economic data in that country.

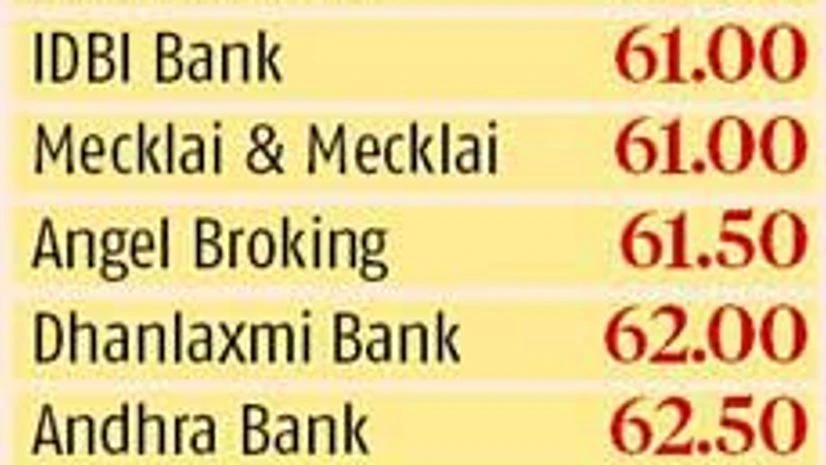

The median forecast poll of 12 currency experts by Business Standard on Thursday showed the rupee was expected to trade at 61.75 a dollar after a month.

In the US, through the next few days, key data is expected to be announced, including those on non-farm payroll, jobless claims and unemployment rate. It is expected the US economy saw an improvement, and this will be reflected when these data are released. "The US data points may again raise concern on tapering by the US Fed. That country is looking at the unemployment rate as the biggest indicator of a recovery in the economy," said Pramit Brahmbhaat, chief executive of Alpari Financial Services (India). However, he agreed the Reserve Bank of India (RBI) would ensure the rupee didn't weaken significantly from current levels.

In the recent past, RBI has been intervening in the market through state-run banks to arrest any sharp depreciation in the rupee. The fall in the rupee has been due to the dollar demand from oil marketing companies.

Kishore Narne, associate director (commodity and currency business) at Motilal Oswal Commodities Broker, said after a month, the rupee will strengthen from current levels due to dollar flows in domestic markets. Narne estimates the rupee will stand at 60.5 a dollar after a month.

Experts, however, said the rupee's gain against the dollar may come after a brief period of depreciation in the next couple of weeks.

In a statement earlier this week, RBI said the swap windows for foreign currency non-resident (bank) funds and banks' foreign borrowings had mobilised $34 billion. The two facilities were closed on November 30. Besides, the country's current account deficit (CAD) narrowed in the quarter ended September. These factors are seen as positive for the rupee.

)