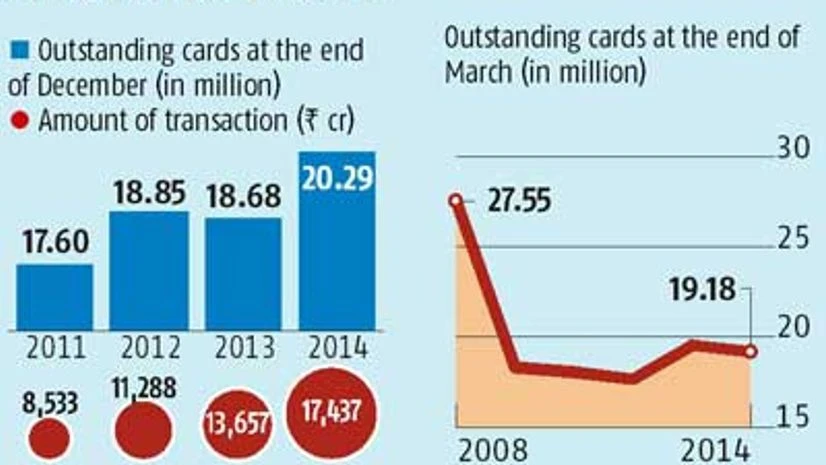

The country's credit card base has crossed the pre-crisis level and is now well above the 20-million mark. According to the Reserve Bank of India (RBI) data, the number of outstanding credit cards at the end of December was 20.29 million, the first time since February 2010.

Bankers say the rise in e-commerce and improved infrastructure in the banking system, leading to easy acceptance of cards, have helped in their growth. In fact, with the rise in online shopping, banks expect the number of cards in the system to increase even further.

According to a Morgan Stanley report, India's internet market can grow to $137 billion by 2020 (a compound annual growth rate or CAGR of 43 per cent) from $11 billion, and e-commerce will form the largest part of the internet market at $102 billion.

"Shopping on the internet, mobile applications and the use of cards in the digital space have increased. In fact, most banks now have a tie-up with some websites offering additional discounts for the cards, and all this has helped card spends go up. It is not only shopping, but even things like recharge, paying bills, booking for movies, etc - everything happens online and this has helped boost spends," said the head of retail at a private bank.

Apart from rise in online spends, the convenience of doing transactions is another reason that has led to the surge, say bankers. "As the aspirational consumer migrates to more sophisticated way of making payment the credit card base will increase even further. Apart from the ease it offers, consumers are also more aware of how to manage credit wisely. Therefore, the growth is going to continue," said Anil Ramachandran, head retail unsecured assets (credit card and personal loan) at IndusInd Bank.

RBI data suggest it is not just the number of cards in the system but even the spends on these cards have gone up significantly. At the end of December 2011, the spends on credit cards stood at Rs 8,532.6 crore, which has more than doubled to Rs 17,437.1 crore by the end of December 2014.

Deepak Chandnani, chief executive officer of Worldline India, a player in the payments and transactional services, says apart from the rise in card acceptance, the upbeat sentiment in the sector has also boosted growth. "The economy is on track and when that happens then the loss on cards in terms of delinquencies reduce. As a result, banks are also willing to extend and expand their customer base."

However, unlike the crisis period of 2008-09, this time the rise in the number of cards in the system is considered to be "healthy" with the number of non-performing cards being limited. With credit information bureaus and a ready Cibil score available, banks have been doling out cards only to consumers who have repaying power. Apart from the credit score, most lenders also offer cards only if one has a banking relationship with them, which helps them asses the consumer's credit-worthiness.

Vijay Jasuja, chief executive officer of SBI Cards (a joint venture between State Bank of India and GE Capital), believes this rise in credit card base is sustainable as lenders are being aggressive but are calculative about the risk they are taking on. "The growth has been calculated and gradual and that is why I believe the momentum can be sustained. Moreover, RBI has also been saying the use of cash in the economy should be reduced and card usage be increased. All this will help in the growth."

)