About two years ago, when the Reserve Bank of India raised a red flag on United Bank of India, it turned out that the lender was sitting on piles of non-performing assets. The Kolkata-based bank had reported a net loss of Rs 1,238 crore in the quarter ended December 2013, its gross non-performing assets (NPAs) had touched 10.82 per cent and net NPAs were close to 7.44 per cent. Subsequently, the regulator imposed curbs on its expansion, hiring and lending.

Today, as some of the big public sector banks slip into the red, UBI is better off. It reported a profit of Rs 17 crore for the quarter ending December 31 2014, although 59 per cent less on a year-on-year basis.

Two other Kolkata-based banks, UCO Bank and Allahabad Bank are now set to follow in the footsteps of UBI in imposing a slew of austerity measures. Allahabad Bank has closed six of its unviable branches and is planning to shut down two more. The bank has curtailed its advertising expenditure, and is likely to recruit fewer people next year. UCO Bank would also tread cautiously in branch expansion and credit growth, said a bank executive.

There are apprehensions that if the banks end the financial year in losses, the new year could come with even more stringent cost cutting measures. Employees of the banks are apprehensive they might see a cut in staff welfare fund. Banks are required to set aside up to 3 per cent of their net profit for the staff welfare fund. The actual amount by each bank depends on the number of employees.

Sources at Allahabad Bank said if the bank’s full year operations showed a net loss, there was a chance the fund could be curtailed or withdrawn. Every year, the bank spends around 1.5 per cent of its net profit on staff welfare, which includes free health check-ups, lunch allowance and events like family day functions.

Rakesh Sethi, chairman and managing director of Allahabad Bank, could not be reached for comments. However, bank unions said any move to withdraw the staff welfare fund would be opposed by them.

‘The losses that banks are showing are not actual losses. These are on account of higher provisioning. Moreover, the banks can always sell the underlying securities and return to profitability. We are watching the situation, and if after the next quarter there is any move towards withdrawing the staff welfare fund, we will oppose it,” said S S Shishodia, president, All India Bank Officers’ Association. UCO Bank is planning to launch a focused recovery drive soon.

“We will take all types of measures for recovery, which includes sale to asset reconstruction companies, going for compromises, and invoking strategic debt restructuring,” said Charan Singh, executive director, UCO Bank.

The bank is looking to sell around Rs 1,000 crore of bad loans to asset reconstruction companies in the present quarter. It is expected to invoke SDR in four or five cases in the present quarter.

UCO Bank will also seek fresh capital from the government. Earlier, the bank had sought close to Rs 1,000 crore from the government.

“Once we receive approval from the government on equity infusion, we will have to evaluate how much more money we require. We might go in for raising Tier I bonds or preferential share of equity capital,” said Singh.

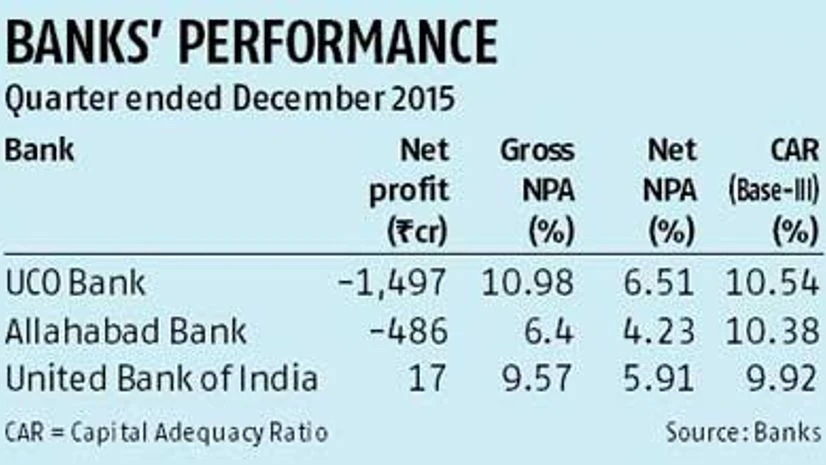

UCO Bank reported a net loss of Rs 1,497 crore for the quarter ended December 2015 against a net profit of Rs 303 crore for the same period a year ago. The gross NPAs of the bank stood at 10.98 per cent in the last quarter against 6.50 per cent in the same period a year ago. The net NPAs stood at 6.51 per cent in the last quarter against 4.25 per cent in the same period a year ago.

Allahabad Bank reported a loss of Rs 486 crore for the third quarter against a net profit of Rs 164 crore in the same period a year ago. The net NPA ratio of the bank stood at 4.23 per cent against 3.89 per cent in the same period a year ago. The gross NPA ratio stood at 6.40 per cent in the quarter against 5.46 per cent in the same period last year.

United Bank of India is still treading with caution over branch expansion and credit growth. The bank would go slow in deposit mobilisation to bring down the cost of funds, said a bank executive. United Bank of India is planning to raise up to Rs 1,000 crore Tier I capital.

According to RBI norms, prompt corrective action triggers, if the capital to risk-weighted assets ratio (CRAR) is less than nine per cent or equal or more than six percent or net NPA crosses 10 per cent. In the case of UBI, as on December 2015, the capital adequacy ratio as per Basel III stood at 9.92 per cent , that of Allahabad Bank at 10.38 per cent, and UCO Bank at 10.54 per cent.

)