ICICI Bank, the country's largest private sector lender, has reduced the interest rate on its home loans by only 25-30 basis points (bps), even though it reduced its base rate by 35 bps last week.

This is because the bank has increased the margin on its home loans by 10 bps to 30 bps. Earlier, the lender had a spread of only 20 bps for its home loans.

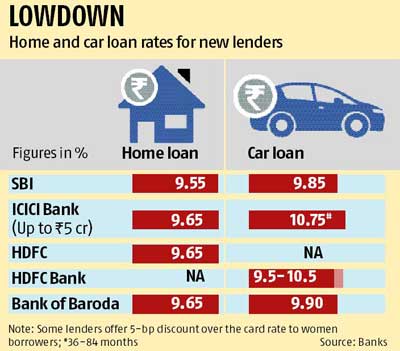

With this change, the interest rate on home loans has come down to 9.65 per cent for new borrowers and 9.60 per cent for women borrowers. However, existing borrowers will be paying a less rate of interest of 9.55 per cent. This is because the loan for the existing borrowers will get re-priced in accordance with the base rate cut.

Last week, the lender reduced its base rate by 35 bps to 9.35 per cent, which became effective since October 5. The reduction in the base rate came after the Reserve Bank of India (RBI) reduced the repo rate by 50 bps in its fourth bi-monthly policy review.

Axis Bank, too, reduced its interest rates on home loans by 30 to 35 basis points to new customers to 9.60 per cent for loans up to Rs 28 lakh and 9.65 per cent for loan amounts above Rs 28 lakh. Recently, it had reduced its base rate by 35 bps to 9.50 per cent.

RBI has reduced the repo rate by a total of 125 bps in 2015, but base rate cuts by banks have been only 35-70 bps till now. The regulator, on several occasions, has pointed out that the rate cut transmission by banks hasn't kept pace.

At the end of the quarter ended June, for ICICI Bank, home loans accounted for 55 per cent of the total retail loan book. By increasing the spread, the bank will be able to reduce the pressure on its margins that would have come with the reduction in base rate. Net interest margin for the bank stood at 3.54 in the first quarter of FY16.

Apart from ICICI Bank and Axis Bank, Indiabulls Housing Finance has reduced the interest rate on home loan by 25 bps to 9.60 per cent.

)