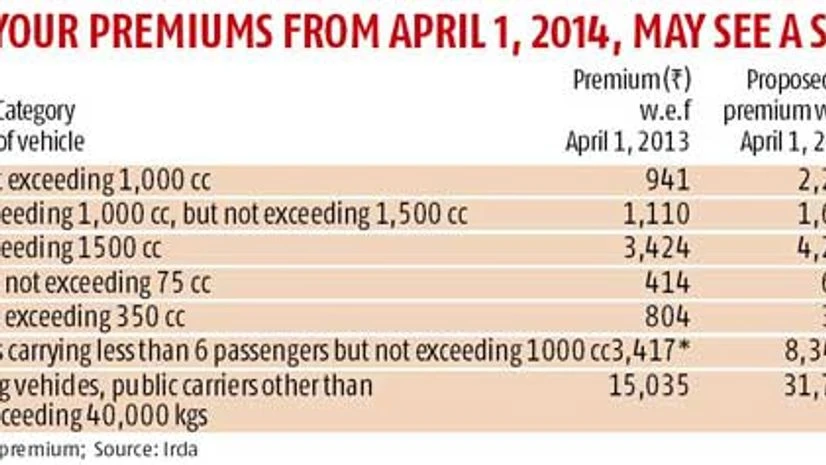

The Insurance Regulatory and Development Authority (Irda) has proposed a steep rise in premiums for 2014-15. In the exposure draft on revision in premium rates for motor third-party (TP) insurance covers for 2014-15, released on Tuesday, Irda proposed an increase of 25-137 per cent for private cars and 1-45 per cent for two-wheelers.

General insurance executives had sent a representation to the regulator to consider an increase of 50-60 per cent in motor TP premiums, in view of the rise in loss ratios in the segment.

Motor TP insurance is mandatory for all vehicles plying on Indian roads. It covers liability arising from third-party claims due to accidents.

For goods-carrying vehicles (public and private carriers) exceeding 40,000 kg, the premium rise could be above 100 per cent, Irda said in its exposure draft.

On the other hand, Irda has proposed a 1-13 per cent decrease in premiums for goods-carrying vehicles weighing below 12,000 kg.

For four-wheeled vehicles carrying passengers for hire (not more than six passengers), an increase of 24-144 per cent has been proposed. Similarly, for three-wheelers carrying up to six passengers may have a premium rise of 26.58 per cent

Motor TP pricing is not de-tariffed by Irda. The authority considers factors such as cost inflation index notified by the Central Board of Direct Taxes and claims experience of companies while deciding on the premiums.

According to Irda, the average size of death claims in motor TP policies has seen a 27.2 per cent rise for 2012-13 (as on March 30, 2013), compared to the previous year. In fact, from 2009-10 onwards, there has been a steady increase in death claims size in this segment (barring 2010-11 when there was a 9.38 per cent increase compared to 16.26 per cent increase in 2009-10).

It is almost two years since the TP pool for commercial vehicles was done away with. However, the combined ratios for the motor insurance segment stand at 130-135 per cent for the industry, owing to losses in the TP motor segment. A ratio below 100 per cent indicates an insurer is making profits.

There is unlimited liability in motor TP policies, meaning that there is no limitation on the size of the claim. Hence, there has been a steady rise in death claims year-on-year. The revised Motor Vehicles Act, which is yet to be tabled in Parliament, limits liability at Rs 10 lakh; which insurers said will help contain losses.

Estimates suggest there is an average 15-20 per cent increase in the quantum of claims awarded in TP insurance by courts.

Non-life insurers said inadequate price rises in the TP motor segment and unlimited compensation for TP claims have led to high losses. Insurers said the claims ratio was significantly high - companies paid claims that were 60-100 per cent higher than the premium earned. Motor insurance comprises two segments - own damage cover, which is optional, and the mandatory third-party cover.

Last year, there was a 20-30 per cent increase in motor TP premiums across different categories of vehicles, with an average increase of 18 per cent. Insurers had demanded 40-50 per cent increase. Transporters' associations had expressed their dissatisfaction with this steep rise proposed by insurers.

All stakeholders have been asked to provide their views on this draft by February 28, 2014 after which Irda will bring out the final guidelines.

)