Banks having government securities above what is mandated will find it easy to meet the new liquidity coverage ratio (LCR) norms of the Reserve Bank of India (RBI).

Banks are required to invest in government papers at least 22.5 per cent of their net demand and time liabilities, termed the statutory liquidity ratio (SLR). On Monday, the central bank prescribed that banks needed to maintain a 60 per cent LCR from January 1, 2016, to be increased in a phased manner to 100 per cent by January 1, 2019.

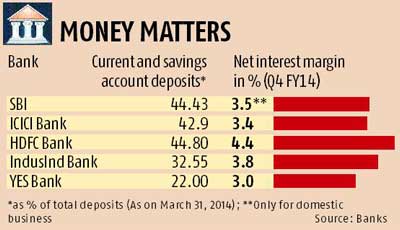

Bankers said lenders with a higher SLR and stronger current account and savings account (Casa) deposits will find it easier to maintain the ratio. Banks with a lower proportion of these low-cost deposits are likely to get impacted on net interest margin, analysts said.

“While SLR is to be kept at 22.5 per cent, most banks have been operating at a higher level of 28-29 per cent. These banks will stand to gain, as they can either liquidate (the excess) or lend to RBI on the repo window and meet the new requirement as the need arises,” said one.

It is due to low credit demand that banks have been parking additional money in SLR. When credit offtake increases, liquidating the additional SLR might not be an option. Therefore, say experts, banks also need to focus on additional things such as growing the Casa base and parking money in more liquid options such as mutual funds.

“Banks that have good Casa ratios will be in a better position to deal with the LCR requirement as the net outflows in near-term buckets can be managed better. Relief (on SLR) overtime will also be helpful in maintaining the LCR. Over time, this will lead to more sensitive asset liability management, as there will be a cost to bunching of liabilities and near-term mismatches,” said Shinjini Kumar, executive director, Pricewate-rhouseCoopers India.

Apart from a strong Casa, says Shyam Srinivasan, managing director of Federal Bank, banks with a lower exposure to corporate deposits will be relatively less impacted, as volatility on the liquidity front will be less. The new norms will also ensure better liquidity risk management.

A Credit Suisse report says the new norm might impact a few banks negatively. “The guidelines put emphasis on granularity of the funding sources (higher rundown for corporate wholesale deposits) and discourage excessive reliance on short-term funding.” It says banks with weaker liability franchises like YES Bank and IndusInd Bank are at a disadvantage. “If the rules are fully applied from March, this would impact margins by 10-40 basis points and earnings by 5-25 per cent,” the report said.

YES Bank’s Casa ratio as on end-March was 22 per cent, while its net interest margin for the quarter was three per cent. IndusInd Bank had a net interest margin of 3.75 per cent and a Casa ratio at 32.55 per cent in this period.

ALSO READ: RBI introduces liquidity ratios for banks

)