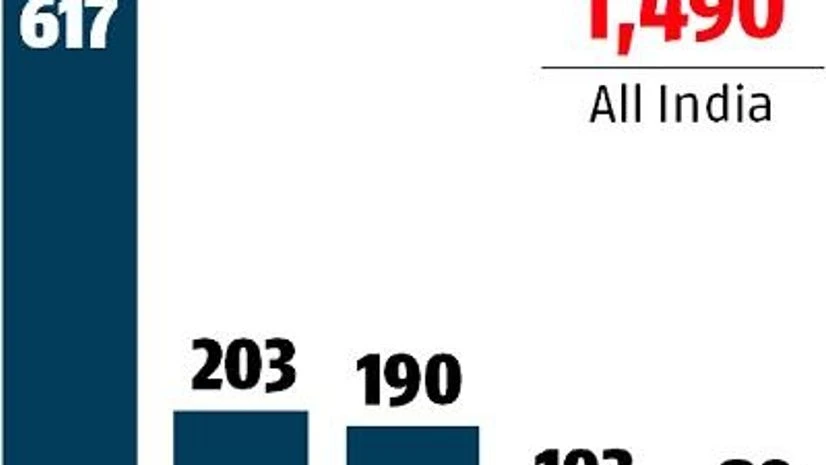

Stepping up oversight over credit companies, the Reserve Bank of India has cancelled the registration of 1,490 non-banking financial companies (NBFCs). These included NBFCs that failed to meet prudential norms and those that voluntarily surrendered registration.

Kolkata tops the list with 617 cancellations, and New Delhi stands at second spot with 203, followed by Mumbai at 190, according to the data provided by the RBI for parliamentary questions (Lok Sabha).

These cancellations happened owing to non-compliance with mandatory requirements like minimum net-owned funds (NoF) of Rs 20 million, not submitting statutory returns, and companies not being traced at the addresses they gave.

In

)