The interest rate cut on savings deposits by the country’s largest bank, State Bank of India (SBI), would have a positive implication on its margins in the short-term.

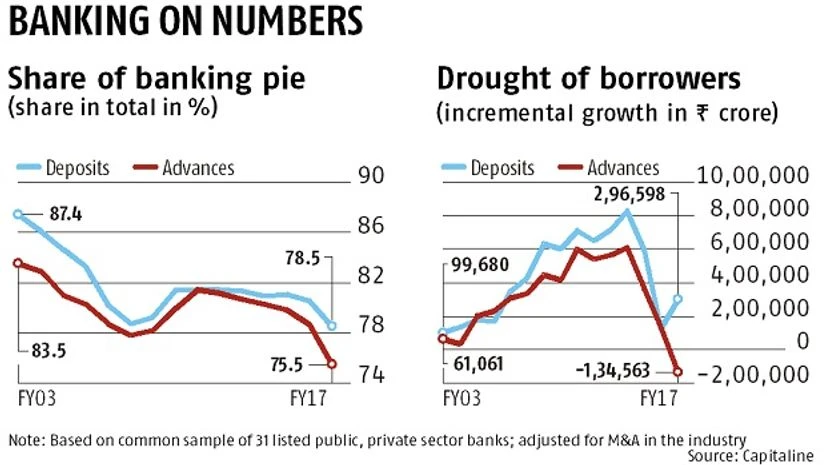

Public sector banks’ (PSBs’) liability franchise, which has proved to be more resilient over the years than their lending business, is likely to see a decline, as depositors move their savings to banks and instruments offering higher interest rates.

Other PSBs are also likely to cut rates on savings accounts, which, analysts say, will not be a bad thing for them. “SBI may lose some of the current and savings deposits to

)