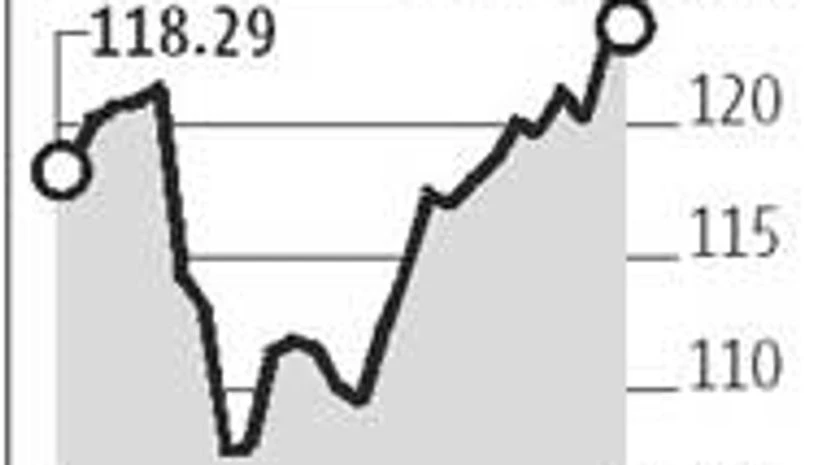

The rupee is trading strong against most major currencies. The Real Effective Exchange Rate (REER) for six-currency trade-based weights was at an all-time high of 124.34 in February.

However, the high REER is hurting exports. Reserve Bank of India (RBI) data issued on Tuesday showed the merchandise trade deficit ($39.2 billion in the December quarter or Q3) had widened from the earlier quarter, due to a larger decline in export (7.3 per cent) than in import (4.5 per cent). In year-on-year changes, too, the trade deficit in Q3 widened due to a decline in exports (one per cent), while imports rose (4.5 per cent).

“The high REER indicates the rupee is strong against almost all major currencies, except for the dollar. This is hurting our exports," said Anindya Banerjee, currency analyst, Kotak Securities.However, the high REER is hurting exports. Reserve Bank of India (RBI) data issued on Tuesday showed the merchandise trade deficit ($39.2 billion in the December quarter or Q3) had widened from the earlier quarter, due to a larger decline in export (7.3 per cent) than in import (4.5 per cent). In year-on-year changes, too, the trade deficit in Q3 widened due to a decline in exports (one per cent), while imports rose (4.5 per cent).

The rupee ended at 62.78 to the dollar on Wednesday, after opening at 62.84 and trading in a range of 62.88 to 62.70.

“The rupee is headed towards 63.50 a dollar in the immediate future. I am referring to the time frame of three months. Due to concerns of a hike in interest rates in the US, funds are moving out. We have seen volatility on the downside for the equities market,” said Naveen Mathur, associate director (commodities and currencies) at Angel Broking.

The rupee is also expected to weaken because RBI has been mopping dollar flows attracted by domestic markets. Its net dollar purchases from the spot market rose to a near seven-year high in January to $12.14 bn, a level earlier seen in January 2008, when it had amounted to $13.63 bn.

RBI’s foreign exchange reserves hit an all-time high of $338.08 bn for the week ending February, showed data issued last Friday. The rise in the week was $3.89 bn.

RBI Governor Raghuram Rajan had recently said an excessively strong rupee was undesirable and the central bank would act to check any volatility in the currency's value.

“By the middle of this month, the rupee might weaken further because there will be dollar demand on account of defence-related payments,” said Sandeep Gonsalves, foreign exchange consultant and dealer, Mecklai & Mecklai.

Meanwhile, the 10-year bond yield climbed to the highest level in almost two months, ahead of retail inflation data to be issued on Thursday. It is believed that inflation had marginally inched up for February, compared with the previous month.

The yield on the 10-year benchmark bond ended at 7.76 per cent on Wednesday, the highest since January 14, compared with Tuesday's close of 7.75 per cent.

)