An autonomous and apolitical central bank is a delicate arrangement too, and will work only if the government respects the autonomy of the central bank, and the central bank itself stays within its mandate, delivers on that mandate and renders accountability for the outcomes of its policies and actions.

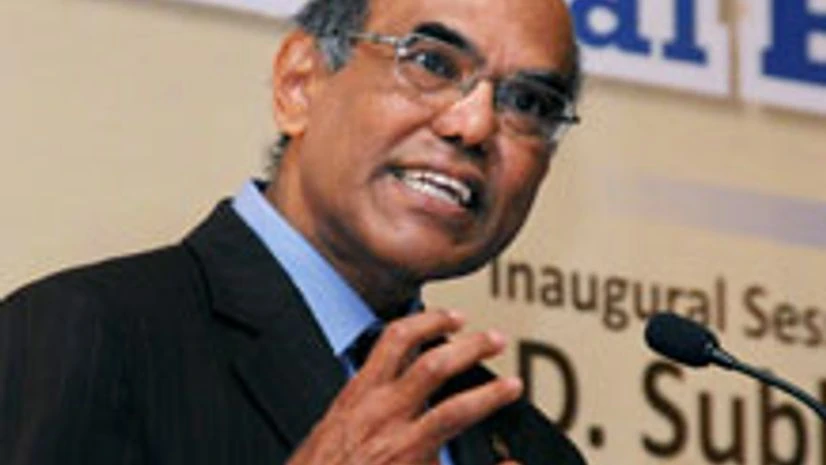

The Chinese have an adage: “May you live in interesting times.” I can hardly complain on that count. I had come into the Reserve Bank five years ago as the ‘Great Recession’ was setting in, and I am finishing now as the ‘Great Exit’ is taking shape, with not a week of respite from the crisis over the five years.

Notwithstanding all the tensions and anxieties of policy management during an admittedly challenging period, I consider myself privileged to have led one of the finest central banks in the world during such an intellectually vigorous period.

More From This Section

During crisis times, it helps enormously if governments and central banks act, and are seen to be acting, in concert.

There were critics who argued that we were too soft on inflation, that we were late in recognizing the inflation pressures, and that even after recognizing such pressures, our ‘baby step’ tightening was a timid and hesitant response. Had the Reserve Bank acted quickly and more decisively, inflation could have been brought under control much sooner. Our ‘baby steps’ were therefore a delicate balancing act between preserving growth on the one hand and restraining inflation on the other.

With the benefit of hindsight, of course, I must admit in all honesty that the economy would have been better served if our monetary tightening had started sooner and had been faster and stronger

I do not agree with the argument that the Reserve Bank failed to control inflation but only ended up stifling growth. WPI inflation has come down from double digits to around 5 per cent; core inflation has declined to around 2 per cent.

We have been running a current account deficit (CAD) well above the sustainable level for three years in a row, and possibly for a fourth year this year. We were able to finance the CAD because of the easy liquidity in the global system. Had we used the breathing time that this gave us to address the structural factors and brought the CAD down to its sustainable level, we would have been able to withstand the ‘taper’. In the event, we did not. We therefore made ourselves vulnerable to sudden stop and exit of capital flows driven by global sentiment; the eventual cost of adjustment too went up sharply.

Click here for the entire speech

Click here for the entire speech

)