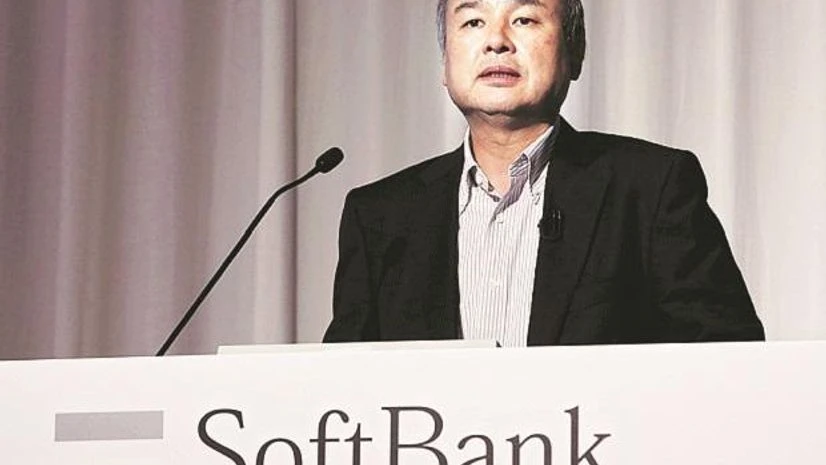

SoftBank Group Corp Chief Executive Masayoshi Son mounted a defence of his investing decisions on Thursday, saying the value of the Japanese conglomerate's holdings has recovered to pre-coronavirus outbreak levels.

"We have worried a lot of people who thought that SoftBank is finished or is 'SoftPunku'," Son told a shareholder meeting, using a play on the word "puncture" used colloquially in Japanese when something is broken.

The rise in corporate value was driven by the growth of SoftBank's stake is Chinese e-commerce giant Alibaba Group Holding Ltd and following the merger of its U.S. wireless unit Sprint with T-Mobile US Inc.

Sprint, which

)