L'Oreal, on course to spend more than $5 billion on acquisitions in the first half of 2014, may just be getting started. "We are confident that we will find other opportunities this year or next year," Jean-Paul Agon, the Paris-based company's chairman and chief executive officer, says. "This is the story of L'Oreal."

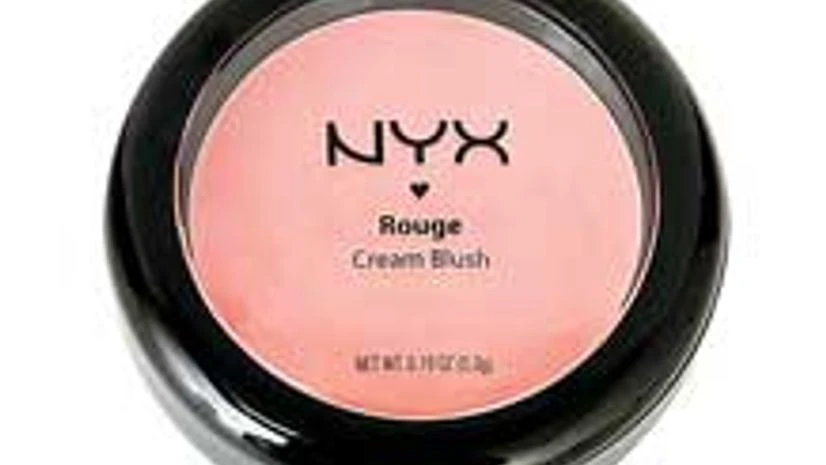

L'Oreal, the world's largest cosmetics maker, on Wednesday, agreed to acquire Los Angeles-based NYX Cosmetics for an undisclosed price to bolster its makeup offerings in North America, where the consumer-products unit has faltered. NYX, with $93 million in sales in the year through May, is not indicative of the size of deals that L'Oreal is interested in, Agon says without offering more specifics.

"We thought it was a great opportunity and we took it," Agon says, adding that L'Oreal was solicited by NYX. "We are pretty good at seizing brands that are at the early stage of development and making them huge."

More From This Section

NYX's route to markets

Founded in 1999, NYX sells $6 blush and $10 eyeliner in more than 70 countries, according to its website. The competitor to Estee Lauder's MAC Cosmetics says it is one of the fastest-growing makeup companies in the US. Sales rose 57 per cent in the 12 months ended in May, L'Oreal says.

With NYX, a mass-market brand, L'Oreal aims to replicate the success the company has had with Urban Decay in the prestige segment, Agon says. That will include strengthening NYX's position in North America and expanding distribution internationally, the CEO says.

NYX is characteristic of "the small acquisitions L'Oreal tends to make," Bassel Choughari, an analyst at Berenberg in London, says. L'Oreal can create value for shareholders by widening the brand's distribution internationally, he says.

"NYX has seen tremendous growth in the last decade and I have complete confidence that L'Oreal will remain true to its brand identity and mission," Toni Ko, NYX's founder and chairwoman, says. NYX will continue to operate under the brand's current leadership team, L'Oreal says.

Familiar route

It is a familiar path for L'Oreal. When the company acquired Maybelline New York in 1996, the brand had sales of $300 million, Agon says. Last year, Maybelline revenue was 2 billion euros, he says. Kiehl's will generate 600 million euros of revenue this year, compared with $30 million when L'Oreal acquired the company more than a decade ago, Agon says (L'Oreal is listed in Paris). "NYX will follow the same direction," he said.

Body Shop's woes

One brand that hasn't delivered is The Body Shop, which has struggled since L'Oreal acquired it in 2006. The retailer's sales fell in the first quarter, spurring analysts including Sanford C. Bernstein's Andrew Wood to question whether the company would consider disposing it.

"I'm pretty confident" of turning around The Body Shop, Agon says. "When you ask young consumers around the world what is for them the ideal profile of the brand of the 21st Century, what they describe is exactly Body Shop: natural, respectful of the environment, ethical, good value for money."

)