The launch of new alternative investment funds (AIFs) could take a breather till the time the government resolves the controversy around the recent circular issued by the Central Board of Direct Taxes (CBDT). The July 30 circular has put a question mark over their tax pass-through status at the 'trust' level.

To enjoy tax breaks, AIF providers have been taking the 'trust' route, the most popular vehicle for pooling structures in India. Earlier this month, AIF providers wrote to the Securities and Exchange Board of India (Sebi) and the finance ministry that if CBDT doesn't issue a clarification on the circular, they will shun the launch of new products under the AIF category.

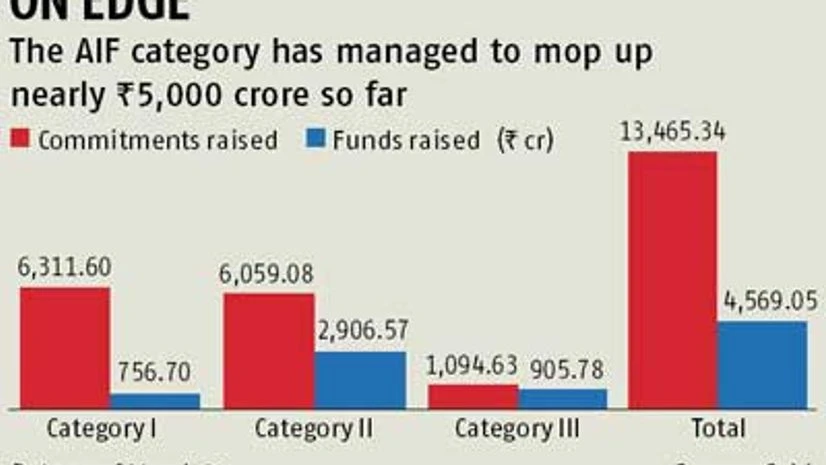

AIFs are funds set up for the purpose of pooling capital for investing in various asset classes. Hedge funds, venture capital funds, and small and medium enterprise (SME) funds are different investment vehicles under the AIF umbrella. Since its introduction two years ago, AIF market has seen encouraging growth with nearly 100 AIFs being launched.

"The latest circular issued by CBDT has raised serious doubts on the future of AIFs. Many AIFs will end up getting taxed at the highest marginal tax rate of 33 per cent," said an AIF provider, asking not to be named.

He said that instead, the market would focus on launching new products under the portfolio management service (PMS) category, which has better clarity on taxation liability.

The CBDT circular states that AIF providers will have to specify the names of the investors as specified in the trust deed on the 'date of its creation', failing which the AIF will be taxed at the 'maximum marginal rate'.

As an AIF found has multiple closings and new investors get added from time to time, industry players have cited difficulties in providing this information.

According to sources, Sebi has taken up the industry's concern with the finance ministry recently. The finance department in turn has taken up the matter with CBDT and sought clarification.

"This one circular has virtually led the domestic fund industry to the verge of closure. This is not just sad, but would also have a massively negative impact on the economy. The highest risk and most patient capital like that of venture capital will now wind up their business as they will be taxed at the highest rate, instead of the lowest bracket of capital gains tax. In addition, the circular puts the domestic fund industry at a 33 percentage point dis-advantage to their foreign counterparts, who invest in India without paying business income or capital gains tax," said Sandeep Parekh, founder of Finsec Law Advisors

According to industry experts, the impact of this circular could be far reaching as a majority of onshore AIFs have been set up as trust and have corporate clients.

TAX TROUBLES

-

CBDT proposes to tax AIFs under the highest tax bracket of 33%

-

AIFs say if CBDT doesn’t issue clarification, these might avoid launches

- The finance ministry takes up issue with CBDT asking for clarification

)