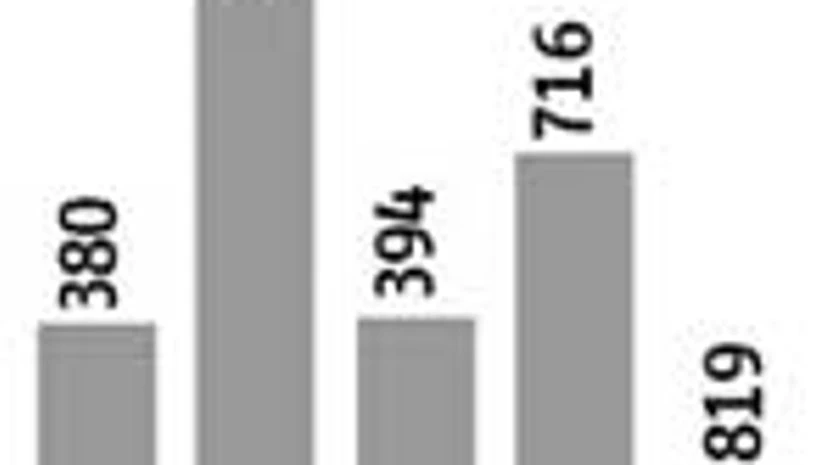

In the past financial year, about 819 stock brokers called it quits, driven by declining profitability and the dominance of low-yielding options volumes, according to figures made available by the Securities and Exchange Board of India (Sebi) in its monthly bulletin.

Volumes in the options segment rose further, after accounting for about three quarters of the trading volume in FY13. The proportion of options, as percentage of overall market volumes, has risen from 9.33 per cent in FY08 to 77.43 per cent in FY14. Trades in the derivatives segment earn lower brokerage than those in the cash segment. Within the derivatives space, options earn the least.

"The trend of the business has been more towards the derivatives segment,” said Alok Churiwala, vice-chairman, BSE Brokers' Forum. "The business of stock broking has not been good through the last few years. So, for brokers to have shut shop was expected…at current levels, the economies of business don't bear out. Costs have also been rising; some brokers who exited could be from regional exchanges, which have been on their way out."

C J George, managing director of Geojit BNP Paribas, said, “A number of brokers are not from the mainstream; they are likely from regional exchanges. With the end of regional exchanges, they likely exited.”

In FY14, the Coimbatore, Saurashtra and Mangalore stock exchanges had shut, after the regulator tightened net worth norms and mandated minimum volumes for stock exchanges.

A total of 913 brokers exited the cash market, while 94 were added to the derivatives segment.

Derivatives accounted for 93.48 per cent of the total turnover in FY14. The larger proportion of derivative trades translates into lower profitability for brokerages, with about 17,000 brokers fighting for a revenue pie of less than Rs 10,000 crore.

At the end of FY14, the total number of stock brokers, in the cash and derivatives segments, was 17,379; the lowest since 2011 (17,088).

)