In 2010, Ajay Kedia, who ran city-based Kedia Stockbroker, was finding it difficult to continue the business he started about seven years ago. Trading volumes in the stock markets had dried up, while activity had shifted to the low-margin options segment. To stay afloat, Kedia decided to venture into the furnishings, information technology (IT) and teaching businesses.

Now, these three businesses are helping Kedia offset the revenue losses from his broking business, prompting him to spend more time in nurturing these. “In 2010, I had a team that looked into the day-to-day activities of my other businesses. Now, I take personal interest in other businesses, too, and spend my weekends working there. I also try and make time on weekdays, too,” said Kedia, in his early 30s.

In 2010, 80 per cent of Kedia’s revenues came from the broking business. This year, he expects half the revenue to be accounted for by the furnishings, IT and education businesses.

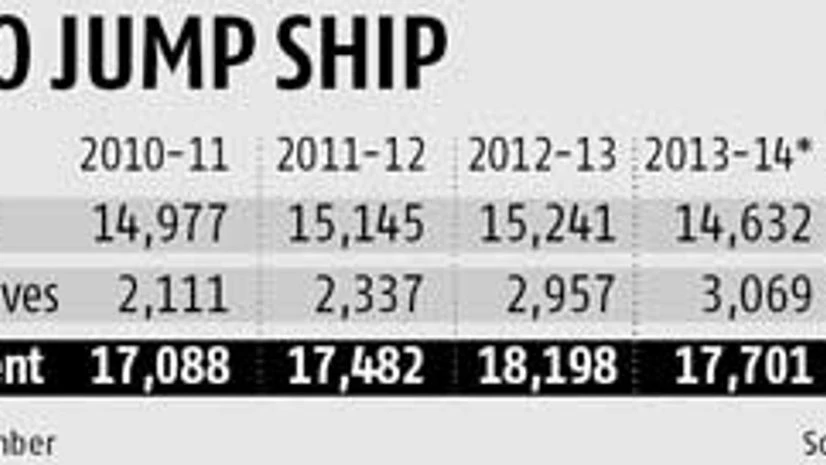

Kedia’s case isn’t isolated. To beat the slowdown that has already claimed about 500 stock brokers since March, brokers are turning to fast food, furnishing, construction, etc. According to the Securities and Exchange Board of India, as of September-end, the number of brokers stood at 9,606, compared with 10,128 a year earlier.

The website of Anugrah, a 10-year-old stock broking company based in Vile Parle here, now has a number customers can dial if they want pizza home-delivered for free.

When the stock market crashed in 2008, brokers began to shift focus towards other markets such as commodities and currencies. But currency and commodities trade, too, was hit by regulatory curbs and the introduction of the Commodities Transaction Tax (CTT), respectively. Brokers complain after CTT was introduced, investors turned to dabba trading, which was carried out off the exchange platform, hitting revenues further.

The emergence of futures and options after 2008 added to brokers’ woes. This year, this segment accounted for about 90 per cent of the average daily trading volumes. Derivatives are a low-margin business for stock brokers.

The story of the relatively well-known Bonanza Portfolio is similar. This year, the Bonanza group’s real estate revenues would exceed revenue from broking, the first time, said senior vice-president, Rakesh Goyal. “The securities broking business hasn’t been doing well since 2008. We were looking to get into other lines of business that could make optimum use of our network. We got into real estate two and a half years ago.”

However, brokers such as Kedia aren’t quitting the broking segment just yet. Kedia intends to rebuild his broking business once the sentiment improves.

)