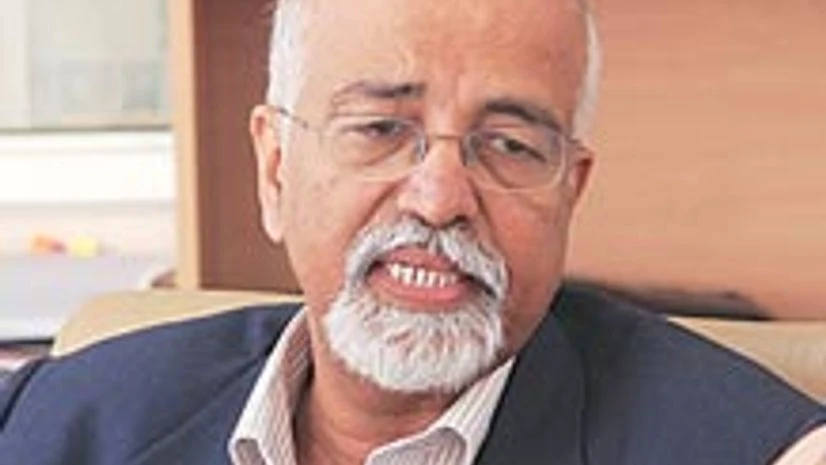

Satyananda Mishra, the newly-appointed chairman of India's largest commodity exchange MCX (Multi Commodity Exchange), is a 1973-batch Indian Administrative Service officer, was India's chief information commissioner. In his first media interview in the new capacity, Mishra spoke to Rajesh Bhayani on a host of issues the MCX is facing and how he plans to put things on track. Edited excerpts:

What is your agenda for MCX?

I came here without any agenda. However, imparting confidence in the members of the exchange, safeguarding their clients for whom exchanges are run and taking care of shareholders' interest who would want their company to make profit are on my priority list. Our board members have started meeting members in different cities and assured them of safety of their margins with the exchange. They have also given suggestions, which we are seriously looking into.

More From This Section

Broker members told us that due to commodity transaction tax, volumes on exchanges have taken a big hit and they have also lost business. They have suggested that to compensate those losses, MCX should cut transaction charges, reduce connectivity charges, and fixed deposits should be accepted as margins so that they continue to earn interest on that while paying margins. We are looking into all of them, but what we can do depends on many things. They also want some new contracts to be launched.

What changes would you like to bring within the exchange? You were heard saying you want to introduce some new processes...

What I meant by introducing new processes was that a government body runs on systems, which sometimes are excessive, but a private company should have some systems for prudent decision-making. MCX does have some systems but we would like to have proper systems and checks and balances; expenses should be aimed at ensuring goals.

Forward Markets Commission (FMC) has ruled that Financial Technologies (India) Limited (FTIL), the anchor investor of the MCX, is not fit and proper. How do you propose to handle this?

MCX is a regulated entity and we have to follow the FMC order. This means FTIL has to bring down its stake in MCX to below two per cent. To comply with the FMC order, we wrote to FTIL asking it to dilute its stake to meet the FMC order and as of date the order stands despite it being challenged in the court. FTIL, however, wrote to us questing the validity of our decision. We have just acted to comply with the FMC order, failing which our licence could be at risk. We also may have to take a legal opinion.

Things are not simple. FTIL also has a long-term contract to provide technology back-up to the MCX.

Is that contract under review?

We have not discussed that issue in the board. However, we will look into the circumstances in which that agreement was signed and other aspects of it. At present, they are providing technology and such things can't be decided in haste.

But both MCX and FTIL holds five per cent stake each in MCX-SX. What is MCX doing about it?

We hold close to five per cent in the stock exchange and together with FTIL, this (combined stake of 10 per cent) was to be reduced to five per cent, the deadline for which is ending soon. From the MCX side, we have written to the Sebi (Securities and Exchange Board of India) requesting for more time in the current environment to comply with the stake dilution direction of Sebi.

)