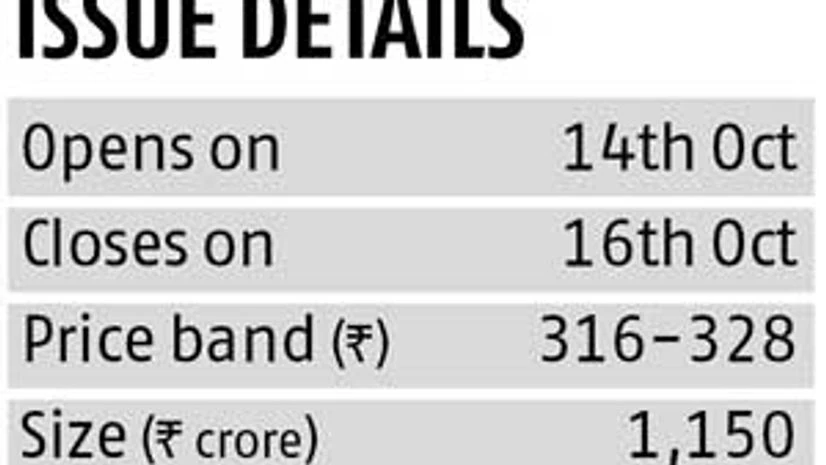

Coffee Day Enterprises (CDEL), parent company of the Cafe Coffee Day (CCD) chain of cafes (1,538 in India), is to have an Initial Public Offer (IPO) of its equity, worth Rs 1,150 crore.

It is the coffee business the market is gung ho about. This business (the CCD retail chain, corporate coffee vending machines and exports, under Coffee Day Global) is nearly half of annual revenue and about 45 per cent of earnings before interest, taxes, depreciation and amortisation (Ebitda). Key strengths include the owned and registered CCD brand (in 40 countries), a vertically integrated coffee business and a strong management team. Apart from being a well-known brand, with nearly half of domestic market share.

While competitive intensity in the business is high, CCD's record provides confidence. The coffee business is also seen growing faster, leading to a higher share of CDEL’s revenues as one goes ahead.

However, CDEL is a holding company and the market typically ascribes a 20-25 per cent discount to the total value of such companies. This is because a holding company's financials and prospects are dependent on dividends paid by its various subsidiaries and their respective fortunes. Also, a lack of direct control. And, the more diversified a company, the more difficult it is for the market to assign visibility and sustainability to its earnings.

The CDEL management, however, remains committed to making all investments only in its coffee business over the next five years. They believe the other businesses are capable of generating enough cash to fund their own entities. This provides some comfort on CDEL's capital infusion strategy.

A little over half the issue proceeds (Rs 633 crore) will be used to repay debt — Rs 510 crore for paying parent company debt and the rest for the coffee business. Further, Rs 288 crore will be used to expand the coffee business. This should help improve profits.

Deven Choksey, managing director, KR Choksey Investment Managers, says: “The coffee business is valued at 1.25 times the FY15 sales, which does not appear expensive. The non-coffee businesses are valued at Rs 3,600 crore of the total valuation of Rs 6,500 crore. Valuations have the potential to increase as business starts generating sustainable profits.”

However, not all analysts share the view. Arun Kejriwal, an investment advisor, believes the valuations are not attractive. Going forward, though, there are a few other catalysts for the coffee business. CDEL has slowed its pace of store expansion from about 200 new ones annually in the past to about 135 for the next three years. This will cap incremental depreciation. Additionally, it has closed a little over 100 stores due to viability issues, which lowers costs further. Repayment of debt will reduce interest costs by 30 per cent. These factors will rub off favourably on earnings.

The coffee business is making cash profit but high depreciation and a break-even time of three to three and a half years for new stores have kept profits under pressure. Despite slowing consumption demand, the coffee business has seen positive same-store sales growth, of three per cent in FY15 and nine per cent in FY14. It was 6.4 per cent in this June quarter.

On the whole, the unrelated assets and holding company structure are major distractions. Weakness in the real estate and IT markets could also impact its SEZ business, while global trade volumes have a bearing on its logistics business. The management, though, believes its investments in the non-coffee businesses can be monetised and utilised whenever a good investment opportunity arises in the coffee business.

In this backdrop, only investors comfortable with the holding company structure and wanting to play the India consumer story might apply.

)