Rewarding investors through dividend payments could hit companies’ balance sheets this financial year. In a report, India Ratings has raised concern on companies that are increasingly relying on debt to fund dividend payouts.

Based on past dividend-paying records, India Ratings estimates 419 of the BSE 500 companies could record aggregate debt of Rs 18,000-20,000 crore for dividend payouts, worth Rs 1-1.2 lakh crore, for FY14. “419 of the BSE 500 companies (excluding banks and financial services companies) adopted an aggressive dividend payment strategy in 2013, despite reduction in net profits,” said India Ratings analysts Sudarshan Shreenivas and Deep N Mukherjee in a report titled ‘Dividend payment behaviour of BSE 500 corporates’. “Despite corporates’ deteriorating business performance, aggregate dividend payments increased steadily over FY09-FY13.”

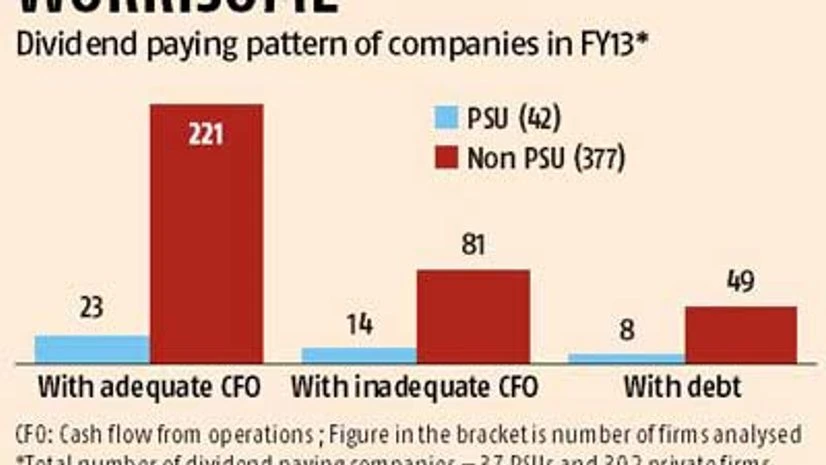

Typically, dividends are paid from companies’ cash from operations flow (CFO). If the dividend paid is higher than the CFO, it is funded through free cash reserves, investments or non-recurring income. Companies that cannot fund dividend through these cash components resort to debt-financing.

In FY13, the total debt taken by these companies to finance dividend payouts stood at Rs 19,176 crore, against the estimated Rs 4,000-7,000 crore through FY09-FY12. In FY13, these companies paid an aggregate dividend and dividend tax of Rs 1.04 lakh crore.

Public sector companies were at the forefront of this, the report said, with eight such companies accounting for 67 per cent of the debt raised in FY13. The reported noted operationally, resorting to debt to pay dividend wasn’t an efficient way for the government to generate revenue. “As a significant number of lenders to public sector undertakings are government-owned banks…if CFO is insufficient, banks could end up funding dividend payments,” the report said.

In the private sector, 49 companies raised debt to pay dividend in FY13. Among these were 14 large companies (leverage of more than five times) that had partly or fully funded dividend payouts through debt.

For the report, India Ratings analysed 377 private and 42 public sector companies. Of these, 302 private and 37 public ones paid dividend in FY13.

)