Endurance Technologies: Casting it right

Given the company's past track record, growth prospects and reasonably valuations, long-term investors can subscribe to the offer

)

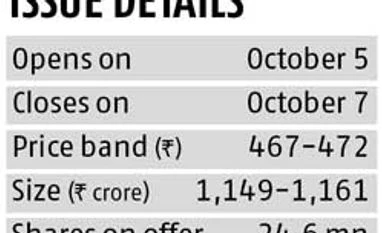

Endurance Technologies is the largest two- and three-wheeler auto component company in India supplying auto makers with aluminium die casts and parts for the suspension, transmission and brake systems. The casting segment is the largest of the four and accounts for 63 per cent of its overall revenues. The IPO is an offer for sale by private equity investor Actis while the promoter, too, is selling a part of his stake. Thus, no part of the proceeds will flow to the company. Nevertheless, given the company’s past track record, growth prospects and reasonably valuations, long-term investors can subscribe to the offer.

The company gets about 55 per cent of its revenues from two-wheelers and sales growth and outlook is an indicator for things to come for Endurance. Over the past six months, two-wheeler sales grew 12.2 per cent year-on-year. If sales to three-wheeler makers are included, then 64 per cent of revenues come from these two segments. CRISIL estimates the two segments to grow 10-14 per cent annually over the FY16-19 period. This should keep the revenue growth rate healthy for the company.

Its domestic revenues have grown nine per cent annually against the domestic sector growth of six per cent for the period FY14-16. Given its past track record of outperformance by increasing its content per vehicle and market share, the company should be able to continue the same due to new clients it has added. What has further aided its performance is that a significant chunk of its domestic revenues come from the premium segment with its two biggest customers being Bajaj Auto (41 per cent) and Royal Enfield (six per cent). Premium segment growth during FY10-16 has been 11 per cent while that of the overall segment has been just 6.5 per cent.

While its other large customers include Honda and Yamaha, it has added Hero MotoCorp to its client list in FY16 and supplies suspension systems. The share of Hero should increase after it starts supplying to the two-wheeler maker’s Halol plant, which will start production in June 2017. New client additions should help the company reduce the dependence on Bajaj Auto. Two-thirds of its overall revenues come from India but this share is on the decline with overseas revenues increasing from 26 per cent to 31 per cent over the past three financial years.

Unlike the domestic market, in Europe, the company caters to the passenger vehicles segment. The European operations fetch operating profit margins of 15 per cent compared to 12 per cent margins in India, because of higher automation, large and complex castings and higher levels of utilisation. Given that its European plants are running at peak utilisation, the company will set up a new plant for Volkswagen in 2017. Going ahead, Angel Broking believes that the company’s revenues from Europe could see an uptick as demand for low-weight aluminium die-casts is expected to increase given stringent emission control regulations. At 20 per cent growth, the European operations have grown at double the average annual revenue growth of the Indian operations over the FY14-16 period. A higher share of existing as well as new clients would be needed if the sales momentum is to continue. The company continues to look for acquisitions to boost growth in this market.

At the upper end of the price band (Rs 472), the company is asking for a valuation of 23 times its FY16 earnings. This, according to analysts, is in line with valuations of listed peers such as Gabriel India and Sundaram Clayton, which trade at 21-22 times FY16 estimates. Given the growth levers for the company both in India and Europe, it is expected to post strong numbers going ahead.

What gives comfort is the strong balance sheet (0.4 debt-to-equity ratio) and robust cash flows. Investors with a two-to-three-year perspective can look at the issue.

The company gets about 55 per cent of its revenues from two-wheelers and sales growth and outlook is an indicator for things to come for Endurance. Over the past six months, two-wheeler sales grew 12.2 per cent year-on-year. If sales to three-wheeler makers are included, then 64 per cent of revenues come from these two segments. CRISIL estimates the two segments to grow 10-14 per cent annually over the FY16-19 period. This should keep the revenue growth rate healthy for the company.

Its domestic revenues have grown nine per cent annually against the domestic sector growth of six per cent for the period FY14-16. Given its past track record of outperformance by increasing its content per vehicle and market share, the company should be able to continue the same due to new clients it has added. What has further aided its performance is that a significant chunk of its domestic revenues come from the premium segment with its two biggest customers being Bajaj Auto (41 per cent) and Royal Enfield (six per cent). Premium segment growth during FY10-16 has been 11 per cent while that of the overall segment has been just 6.5 per cent.

At the upper end of the price band (Rs 472), the company is asking for a valuation of 23 times its FY16 earnings. This, according to analysts, is in line with valuations of listed peers such as Gabriel India and Sundaram Clayton, which trade at 21-22 times FY16 estimates. Given the growth levers for the company both in India and Europe, it is expected to post strong numbers going ahead.

What gives comfort is the strong balance sheet (0.4 debt-to-equity ratio) and robust cash flows. Investors with a two-to-three-year perspective can look at the issue.

More From This Section

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Oct 04 2016 | 10:43 PM IST