The Nifty hit the pause button with choppy trading in the past few sessions. While the European Central Bank's Quantitative Easing Programme has given heart to traders, there are apprehensions about China. Earnings have grown slowly in Q3. Apart from that, the rebasing of GDP data means that everybody, including the Finance Ministry and the Reserve Bank of India (RBI), must review policy models.

A lot depends on the RBI's policy release. "Everyone" is expecting at least a token cut from the central bank. It might not happen. RBI may prefer to wait for the Budget. The argument may be that growth as captured by rebasing has been much better than expected. So, why will RBI cut? Whether RBI cuts or does not cut, the Governor's remarks will be parsed carefully for clues as to the central bank's stance.

The RBI has bought forex in quantity in the past month, boosting reserves to record levels and keeping downwards pressure on the rupee. Otherwise, given an improving Current Account and continued net buying of rupee debt and equity by FIIs, the rupee would strengthen.

Volatility through February is likely. There will be guaranteed turmoil in exchange rates, and there will be punts on the Budget. The Delhi elections could also cause an impact if the BJP fails to secure a majority. The PSU disinvestment programme launched well and that will help sentiment. Domestic institutions are still net equity sellers at the moment.

The Nifty tested resistance at 8,995-9,000 before falling back. It could test support in the 8,700 zone or lower. Day-traders should assume congestion at every 50-point mark. On the upside, a breakout beyond 9,000 is likely, if the RBI cuts or Rajan gives an optimistic briefing.

Breadth has been poor in the derivatives segment and the put-call ratio (PCR) is bearish across both the one-month and the three month timeframe. The 3-month PCR is down to 0.88 and the Feb PCR is at 0.94. Premiums are very asymmetric with calls priced much higher than puts at the same distance from money. The arbitrageurs would be looking to sell calls in this situation.

The Feb Nifty Call chain has open interest (OI) peaking at 9000c, with another smaller OI bulge at 9200c and decent OI till 9,500c. The Put OI is ample between 8,000p and 9,000p with several peaks at 8,500p, 8,600p, 8,700p and also some OI at 8,000p. The Nifty could move 200-points either way in any single session, hitting 8,600 or 9,200. The current value is at 8,798 and the 8,800p (140) and 8,800c (200) are very unevenly priced on the money.

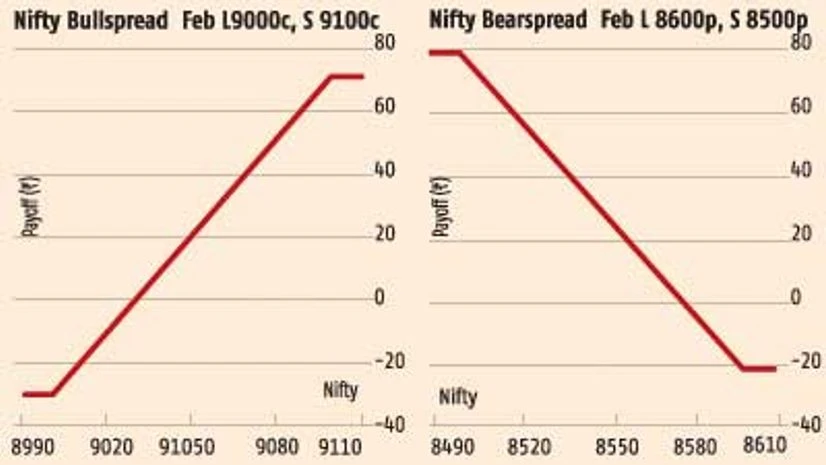

Traders can try wide spreads. A bearspread of long 8,700p (105), short 8,600p (77) is attractive, costing 28 and paying a maximum 72. A long 8,600p, short 8,500p (56) costs 21 and pays 79. A long 8,900c (148), short 9,000c (105) is expensive costing 43, with a payoff of 57. A long 9,000c, short 9,100c (73) is better, costing 32. A long-short strangle set of long 8,600p, long 9,000c, short 8,500p, short 9,100c costs 53, and has an adverse payoff of 47.

)