Indian equities rallied on Friday, tracking gains in other Asian indices, after the US Federal Reserve decided to hold rates, citing weak global growth and a recent spike in volatility.

Market players hoped the Fed’s action would give the Reserve Bank of India (RBI) more room to lower interest rates at its monetary policy review meeting scheduled for September 29.

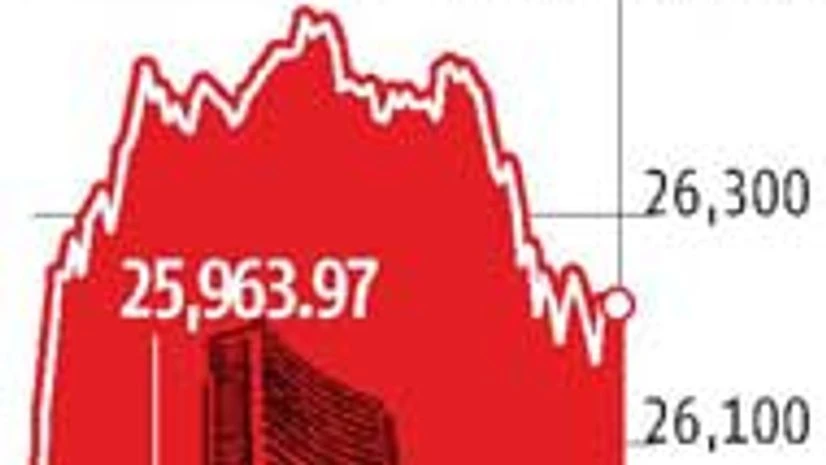

The benchmark Sensex climbed as much as 500 points, before giving up some gains on profiting-booking and doubt over RBI action.

RBI Governor Raghuram Rajan on Friday said it was important to keep inflation under control, adding the use of monetary policy and other short-term incentives to fuel economic growth should be avoided.

“The Fed’s decision not to hike the rate puts to rest the confusion that has bogged emerging markets, including India. The nervousness that has prevailed in the recent past should give way to stability and outflows from emerging markets should be stemmed. It gives a great opportunity to buy many stocks available at lower prices,” said Motilal Oswal, chairman and managing director, Motilal Oswal Financial Services.

On Friday, the 30-share Sensex rose 0.98 per cent, or 254 points, to 26,219, while the 50-share Nifty closed at 7,981, up 82.7 points, or 1.05 per cent. For the week, the market gained 2.37 per cent, the highest weekly gain in about two months.

On Friday, foreign institutional investors (FIIs) bought shares worth Rs 643 crore, while domestic institutional investors bought shares worth Rs 415 crore, provisional data show.

The global risk-off sentiment has led to foreign investors pulling out money from the Indian market. In August, they pulled out a record Rs 17,000 crore, while this month, FIIs have sold shares worth around Rs 3,000 crore, with just two sessions of buying, excluding Friday.

"The US Fed's decision to delay raising rates is positive for interest rate in India, which we expect to come down. Indian equities continue to be good long-term investments, despite emerging market redemptions," said Nimesh Shah, managing director and chief executive, ICICI Prudential MF.

Key Asian indices ended in the green on Friday, with South Korea's Kospi gaining the most, at 0.98 per cent. The Nikkei 225 and Straits Times bucked the trend, losing 1.96 per cent and 0.56 per cent, respectively.

A section of the market believes the Fed's decision to hold rates has added to the uncertainty and could fuel volatility in the near term.

In India, the market breadth was strong, with 1,722 advances compared with 910 declines on Friday. Of the Sensex 30 components, 17 ended in the green. Nine of the 12 BSE sectoral indices ended with gains, with the BSE Realty and BSE Bankex indices advancing the most - 3.1 per cent and 2.66 per cent, respectively.

Experts said the government would have to push ahead with its reforms agenda to spur growth, revive investor confidence and ensure India withstood the global turbulence triggered by fear of a slowdown in China and an interest rate increase by the US Federal Reserve.

Analysts have started downgrading Indian markets due to delay in a recovery in earnings. Through the past few days, Macquarie, Barclays and Ambit have lowered their price targets for the Indian markets, citing weak earnings growth.

The India VIX index, a measure of market volatility in the near term, declined 16.8 per cent to 18.2 on Friday.

)