In the past month, five companies — CEAT, Just Dial, Edelweiss Financial, Bajaj Corp and Pennar Industries — got Reserve Bank of India (RBI) approval to raise their FII-investment limits. Power Grid Corporation has been added to the FII-ban list, restricting foreign participation.

Just Dial saw its FII shareholding limit raised to 75 per cent. For Bajaj Corp and CEAT, it has been raised to 49 and 45 per cent, respectively. Edelweiss Financial Services saw the limit raised for a second time this year —once in April to 28 per cent and another last month to 40 per cent. For Pennar Industries, the limit is now 35 per cent.

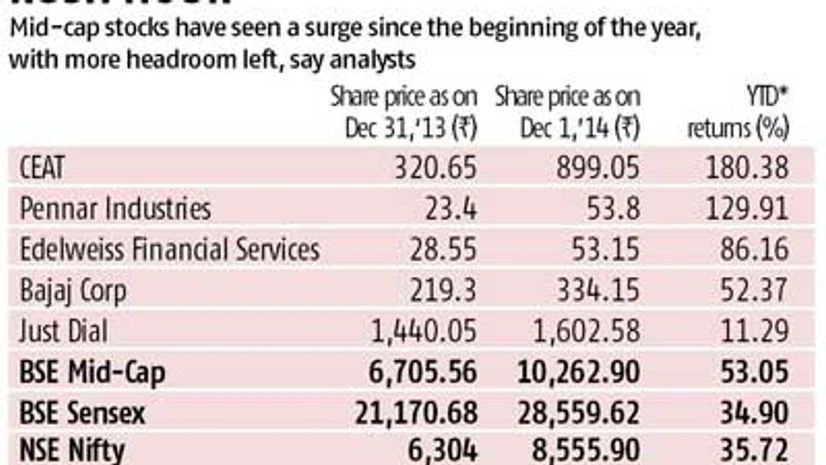

“The way the headline indices have moved, there is not much headroom left in the large-cap space any more. Investors looking for higher returns will have to move beyond these stocks,” said Piyush Garg, executive vice-president, ICICI Securities.

According to RBI's website, 24 per cent is the default limit for FII investment in a company. For state-owned banks, the limit is 20 per cent. This upper limit can be raised by the central bank, subject to a sectoral cap or a statutory ceiling, after approval from the company's board.

Analysts said large-cap names had seen their share of the rally, with most stocks close to hitting the upper limit of FII investment. Of particular interest for FIIs in the large-cap are financial sector stocks, which have seen a significant rise.

The Foreign Investment Promotion Board (FIPB) recently cleared a rise in FII limit in the Street favourite, HDFC Bank, to 74 per cent. Another favourite, IDFC, is still in the FII-ban list. Axis Bank and YES Bank are close to their FII limits. Interestingly, the latter saw its FII shareholding fall to 46.3 per cent, opening it to FII-buying last month. The FII investment limit in the stock is fixed at 49 per cent.

Lupin, which had applied to RBI for a rise in the limit to 49 per cent in October 2013, received the FIPB approval last month.

Experts believe stocks in the mid-cap segment can move up by as much as 50-100 per cent, on the back of the capacity expansion and volumes growth expected in the next two to three quarters. However, the hurdle FIIs could face in this space, despite good valuations, is the lack of liquidity. “The bigger concern for these stocks is the lack of liquidity in these. When investors look to exit these stocks, it should be without too much of an impact cost because liquidity in these stocks is not sustainable over a longer period of time,” said Vivek Mahajan, head of research, Aditya Birla Money.

However, some in the market believe the liquidity issue might be resolved, albeit temporarily, with an increase in FII participation. Typically, a stock with high FII interest also tends to bring in more of retail and high net worth individual investors, they said.

With the recent decline in crude oil prices, mid-cap stocks in the petrochemical space such as paint companies could see higher FII participation, said observers. Similarly, stocks in the automobile ancillary space and tyre sector could also be on the FII-buy list, along with those in the cement sector.

)