Though the markets ended about one per cent lower in the week ended October 25, as investors turned cautious and booked profits after both the benchmark indices hit three-year highs, some fund managers, especially early-starters, recorded reasonable gains. During this period, four of the six participants were active.

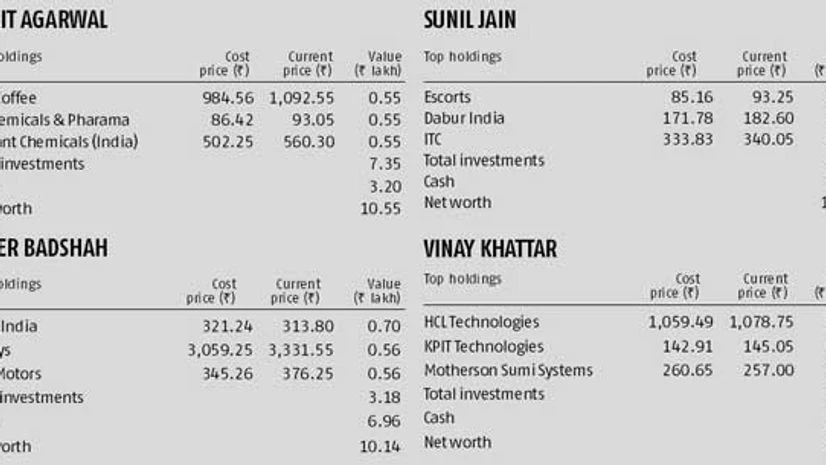

Ankit Agarwal

Vice-president and fund manager, Centrum Broking

After some heavy buying at the beginning, Agarwal added only Clariant Chemicals (India), Maruti Suzuki and Karur Vysya Bank to his portfolio. In the recent move up, Agarwal sold his entire holding in L&T Finance Holdings, with a 14 per cent gain.

His net worth stands at Rs 10.55 lakh, up 5.47 per cent.

Sunil Jain

Head(equity research-retail), Nirmal Bang

Through the last fortnight, Jain's three picks were Escorts, Dabur India and Dewan Housing Finance Corporation. The gains in Escorts and Balrampur Chini Mills helped cushion the losses in some of his other picks. In the meantime, he booked profits in banking stocks-Federal Bank and YES Bank. His net worth stands at Rs 10.36 lakh, up 3.57 per cent.

Taher Badshah

Senior vice-president & co-head (equities), Motilal Oswal AMC-PMS

Tata Motors and Infosys, two of the top gainers from the Sensex pack, helped Badshah edge higher. He had added Infosys to his portfolio before the company announced its quarterly numbers. Cairn India and Tata Coffee were also added during the same time. His net worth is Rs 10.14 lakh, up 1.42 per cent.

Vinay Khattar

Head (research, retail and capital markets), Edelweiss Financial Services

Khattar started building his portfolio with a series of buys, starting with KPIT Technologies, Development Credit Bank, City Union Bank, Natco Pharma and HCL Technologies, among others. Through the fortnight, he bought and sold Tribhovandas Bhimji Zaveri and Accelya Kale Solutions. His net worth is Rs 9.9 lakh, down about one per cent.

Phani Sekhar from Angel Broking and Sachin Shah from Emkay continue to remain on the sidelines. On his inactive status, Sekhar said along with holding stocks for the long term, an important aspect of investing was often underplayed---wait patiently for the right valuations to buy.

For Smart Portfolios, visit www.smartinvestor.in/sp

)