Benchmark indices and several broader indices on Monday scaled new multi-month highs, as investor sentiment received a boost after G20 policymakers vowed to take steps to support global growth.

The Nifty-50 index ended at a 15-month high, while the Sensex touched a new 11-month high, amid strong buying from foreign investors.

The broad-based BSE mid-cap index touched a new all-time high, while the BSE small-cap index ended at a level last seen in January 2008.

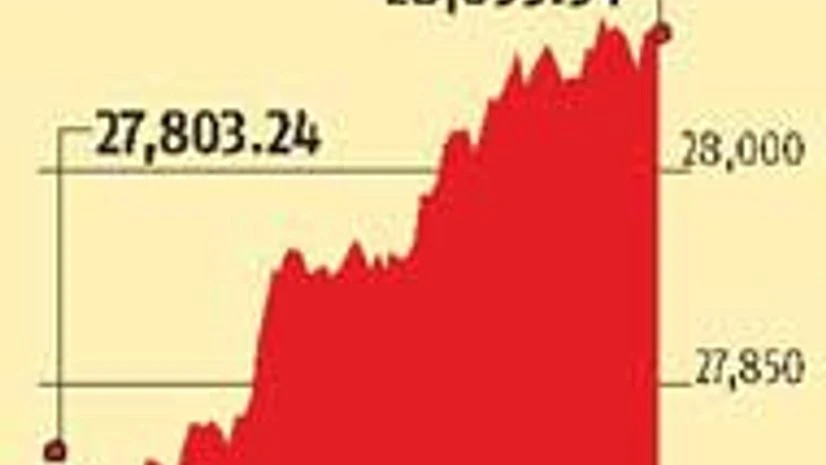

The 50-share Nifty on Monday gained 94 points, or 1.1 per cent to close at 8,635.65 - highest close since April 16, 2015. The Sensex gained 292 points, or one per cent. to end at 28,095.34 - highest since August 10.

G20 finance chiefs over the weekend said they will use "all policy tools" to lift global growth.

Most global markets too, particularly emerging markets, have performed well in July buoyed easy liquidity and expectations of central banks in US, Europe and Japan taking steps to boost growth. The hopes on increased after the UK voted to exit the European Union late last month.

"Central banks have signaled easier monetary policy for longer post-Brexit which is likely to ensure that liquidity conditions remain favourable for growth assets," said Shane Oliver, head of investment strategy, AMP Capital.

Benchmark indices have rallied more than 22 per cent from their 2016 lows touched in February on the back of robust inflows from foreign institutional investors (FIIs) and signs of revival in the domestic economy and earnings.

"The earnings growth cycle is turning. Growth is likely to accelerate in the coming months from around 0 per cent to double digits. We are forecasting 16 per cent and 14 per cent CAGR in earnings for the BSE Sensex and the broad market, respectively, over the next two years… Reforms momentum is intact, but the growth cycle is likely to be U-shaped given headwinds from global sources," Morgan Stanley had a said in a note, while upping its one-year Sensex target 15 per cent to 30,000.

FIIs have pumped in over $4 billion into the Indian markets so far this year, which has seen the Sensex and the Nifty rise 7.6 per cent and 8.7 per cent respectively. Market experts say easy global liquidity and earnings support by domestic companies will be the key for the ongoing rally to sustain.

Driven by strong stock market rally, the total valuation of BSE-listed companies surged to an all-time high of Rs 108 lakh crore on Monday.

At close of trade, market capitalisation (m-cap) of all companies listed on BSE soared to Rs 1,08,03,154 crore or $1.61 trillion.

Investor wealth of BSE-listed firms, measured by market capitalisation, had seen a previous record high of Rs 1,07,00,756 crore on Thursday.

)