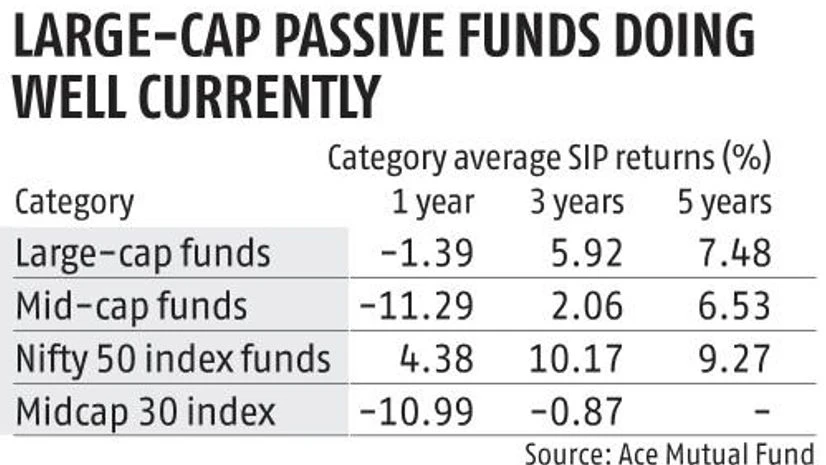

Mutual fund investors, both in debt or equity, are in a quandary today. The category average returns from their systematic investment plans (SIPs) in actively managed large-cap funds over the past one year stands at -1.39 per cent. An investor in a Nifty 50 index fund would, on the other hand, have made 4.39 per cent (category average return). On the fixed-income side, net asset values (NAVs) of many debt funds have been hit by events surrounding Infrastructure Leasing & Financial Services (IL&FS), Zee and DHFL groups. A lot of investors would be worried, and seeking advice if they should

Wednesday, March 05, 2025 | 05:41 AM ISTहिंदी में पढें

Investors should split large-cap allocation between active, passive funds

Fixed-income investors should be in funds that limit both credit and duration risk

)

Premium

What you get on BS Premium?

-

Unlock 30+ premium stories daily hand-picked by our editors, across devices on browser and app.

-

Pick your 5 favourite companies, get a daily email with all news updates on them.

Full access to our intuitive epaper - clip, save, share articles from any device; newspaper archives from 2006.

Preferential invites to Business Standard events.

Curated newsletters on markets, personal finance, policy & politics, start-ups, technology, and more.

Need More Information - write to us at assist@bsmail.in