Marico Ltd, maker of the Parachute and Saffola range of products, could face margin headwinds in the March quarter. While the company has witnessed sluggish volume growth in the recent quarters, rising prices of its key raw materials — copra (dried coconut), kardi oil and rice bran oil — will only add to its worries, believe analysts.

“The significant increase in kardi oil prices, along with the sustenance of the upward movement in copra prices, would affect the gross profit margin of Marico (by 200 basis points) in Q4 FY13 (if the company does not take any price increase in its product portfolio),” brokerage Sharekhan wrote in a recent note. “However, if Marico keeps its prices stable, the company would be able to focus more on improving the sales volume of Parachute in the coming quarter.” For the December quarter, gross margins stood at 52.2 per cent.

At 30.2 times FY14 estimated earnings (against a three-year average of 27 times), the stock appears richly valued. Analysts, according to Bloomberg consensus estimates, are divided on the investment recommendation for the Marico stock, with just about half giving a ‘buy’ call. Most analysts believe upsides from current levels will be marginal.

Input cost pressures

Copra (40 per cent of Marico's input costs) prices have risen 10 per cent to Rs 4,425 per quintal since November 2012. Copra prices are expected to remain firm due to expectations of a better crop in the new season and strong demand. Kardi oil prices (13 per cent of Marico’s input costs) have also risen 42 per cent last year, while rice bran oil (12 per cent of input costs) has remained firm. Both these products are key inputs for Saffola edible oil, which forms 15 per cent of the company’s revenues.

Lower volumes

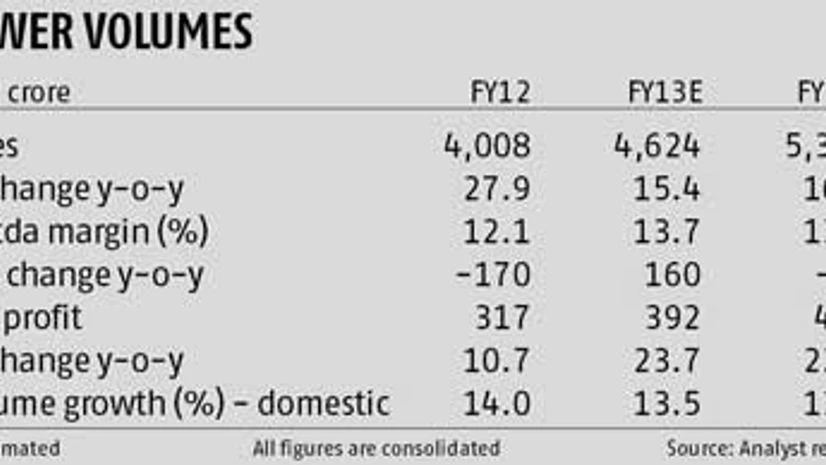

Notably, volume growth across the Parachute and Saffola brands has fallen since the June 2012 quarter due to the weakening demand scenario. From 12-18 per cent volume growth in the first quarter of this financial year, both Parachute and Saffola witnessed single digit volume growth of four-six per cent in the December 2012 quarter.

Abneesh Roy, FMCG (fast-moving consumer goods) analyst at Edelweiss Securities, says: “We believe Saffola could benefit from lower base in the March quarter with just three per cent volume growth, but it is clearly witnessing challenges. However, interest rate cuts could drive discretionary spends and improve sentiments.” Thus, the company’s ability to raise prices is limited in the near term.

Banking on volume growth

V Srinivasan, analyst at Angel Broking, says: “Given the weakening demand, we believe they can do only marginal price hikes to combat higher input costs.” While the management refused to give any indication on the margins, it remained confident on the volume growth.

The company is hopeful of improving volume growth following the marginal price cuts of Rs 2 and Rs 5, respectively, on select packs of Parachute and Saffola. In sync with the trend witnessed in the last four quarters, Marico plans to keep its advertisement, sales and promotional expenses stable at about 12 per cent of sales over the medium term, which could provide some support to the margins.

)