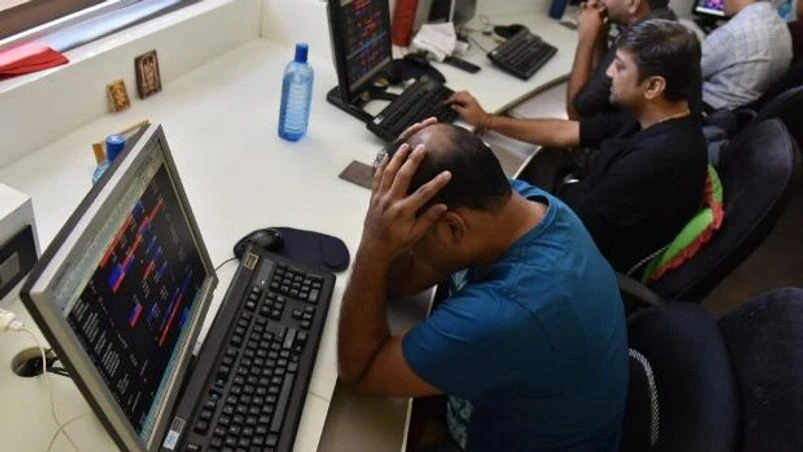

MARKET WRAP: Stimulus package disappoints; Sensex plunges 1,069 pts

All that happened in the markets today

)

Photo: Kamlesh Pednekar

Indian markets slumped over 3 per cent on Monday as stimulus measures announced over the weekend, as part of the government's Rs 20 trillion economic package, failed to cheer investors who were expecting huge fresh liquidity infusion into the system to improve the aggregate demand. Moreover, the government's decision to extend teh nationwide lockdown, albeit with some relaxations, till May 31, also dented sentiment.

The benchmark S&P BSE Sensex tumbled over 1,069 points or 3.44 per cent but managed to close above the crucial 30,000-mark at 30,028.98 levels. NSE's Nifty50, meanwhile, ended the session at 8,823 level, down 314 points or 3.43 per cent. Meanwhile, volatility index, India VIX, rose 7.58 per cent and crossed the 40-mark.

IndusInd Bank (down 10%), HDFC, Maruti, and Axis Bank (all down 7% each) were the top Sensex laggards while TCS, up 2 per cent, gained the most. The HDFC twins and ICICI Bank contributed the most to the Sensex's fall today.

The Nifty sectoral trend remained negative, led by Nifty Bank which crashed 6.7 per cent. On the other hand, Nifty IT index gained 0.9 per cent.

In the broader market, the S&P BSE MidCap index settled 3.75 per cent lower and the S&P BSE SmallCap index shed 2.9 per cent.

Buzzing stocks

Aviation stocks InterGlobe Aviation and SpiceJet tumbled as much as 9.5 per cent on the BSE on Monday after the government's Rs 20 trillion economic package failed to deliver immediate liquidity support to the bleeding airlines. READ MORE

Shares of companies that provide financial services, including banks, non-banking financial companies (NBFCs) and housing finance companies (HFCs), tumbled up to 12 per cent on the BSE on Monday amid concerns that asset quality metrics may come under pressure due to the extended nation-wide lockdown and challenging economic environment. READ MORE

IndusInd Bank (down 10%), HDFC, Maruti, and Axis Bank (all down 7% each) were the top Sensex laggards while TCS, up 2 per cent, gained the most. The HDFC twins and ICICI Bank contributed the most to the Sensex's fall today.

The Nifty sectoral trend remained negative, led by Nifty Bank which crashed 6.7 per cent. On the other hand, Nifty IT index gained 0.9 per cent.

In the broader market, the S&P BSE MidCap index settled 3.75 per cent lower and the S&P BSE SmallCap index shed 2.9 per cent.

Buzzing stocks

Aviation stocks InterGlobe Aviation and SpiceJet tumbled as much as 9.5 per cent on the BSE on Monday after the government's Rs 20 trillion economic package failed to deliver immediate liquidity support to the bleeding airlines. READ MORE

Shares of companies that provide financial services, including banks, non-banking financial companies (NBFCs) and housing finance companies (HFCs), tumbled up to 12 per cent on the BSE on Monday amid concerns that asset quality metrics may come under pressure due to the extended nation-wide lockdown and challenging economic environment. READ MORE

Global markets

European shares bounced on Monday after their worst week in two months, as investors hoped for a gradual economic recovery with many countries easing coronavirus-led lockdowns.

In commodities, Gold rose 1 per cent to its highest in more than seven years as data released on Friday showed US retail sales and industrial production both plunged in April, putting the economy on track for its deepest contraction since the Great Depression.

Brent crude climbed 5.7 per cent higher to $34.35 a barrel, supported by output cuts and signs of a gradual recovery in demand amid easing coronavirus curbs.

(With inputs from Reuters)

3:45 PM

MARKET UPDATE:: Only Alembic Pharma and India Cements hit their respective 52-week highs in an otherwise weak market today

3:44 PM

IndusInd Bank tanks 10%, top Sensex loser today

3:42 PM

Contribution to the S&P BSE Sensex's 1,000-point plunge today

3:38 PM

Nifty sectoral indices at the close of today's session

3:37 PM

MARKET AT CLOSE | Losers and gainers on the S&P BSE Sensex today

3:34 PM

CLOSING BELL

The S&P BSE Sensex tumbles 1,069 points, or 3.44 per cent, to 31,029 levels while NSE's Nifty endd at 8,833, down 304 points or 3.32 per cent.

3:27 PM

» More on 52 Week Low

Stocks that hit 52-week low on BSE today

| COMPANY | PRICE(rs) | 52 WK LOW | CHG(%) |

|---|---|---|---|

| ARVIND FASHIONS. | 121.00 | 119.50 | -8.68 |

| BANK OF BARODA | 38.55 | 38.30 | -7.22 |

| BRIGADE ENTERPR. | 95.95 | 94.45 | -3.95 |

| C P C L | 54.15 | 53.10 | -1.99 |

| CHALET HOTELS | 109.40 | 108.45 | -13.62 |

3:15 PM

MARKET UPDATE:: Sensex breaches 30,000

3:11 PM

India Cements rebounds 14% from day's low on heavy volume; hits 20-mth high

Shares of India Cements surged 8 per cent to Rs 123.50, bouncing back 14 per cent from day’s low on the back of heavy volumes, on the BSE on Monday. The stock of the cement and related products company declined 5 per cent to Rs 108 in the intra-day trade but recovered and hit a 20-month high in the intra-day trade -- its highest level since September 4, 2018. READ MORE

3:01 PM

NEWS ALERT | Wabco India up 10% at Rs 6,837 on the BSE in an otherwise weak market

-- Stock gains after Wabco Holdings Inc and ZF Friedrichshafen AG announced that they have received the regulatory clearance from Chinese State Administration for Market Regulation for the merger.

-- Wabco India, which is part of Wabco Holdings and a supplier for commercial vehicle industry, said that all required regulatory approvals have now been received and Wabco and ZF expect to close the merger

-- Wabco India, which is part of Wabco Holdings and a supplier for commercial vehicle industry, said that all required regulatory approvals have now been received and Wabco and ZF expect to close the merger

2:50 PM

Fiscal stimulus 2.0: Consumption boost for agri, auto and FMCG companies

The slew of measures announced by the finance minister, coupled with a robust rabi crop and lower impact of the Covid-19 pandemic on rural India, is expected to improve rural incomes. The focus on agriculture is evident as 65-70 per cent of the outlay in the second and third tranches of the stimulus package was aimed at the farm sector. READ MORE

2:44 PM

Higher borrowing can see FY21 combined fiscal deficit hit 12%: Economists

The net borrowing ceiling for 2020-21 was earlier pegged at Rs 6.41 trillion (3 per cent of gross state domestic product), and the states have thus far borrowed merely 14 per cent of this authorised limit. Despite this, they have been urging the Centre for a special hike to 5 per cent in order to fight the economic stress triggered by the Covid-19 pandemic. READ MORE

2:36 PM

MARKET CHECK | Top 5 losers on the BSE at this hour

2:27 PM

Earnings Alert | Dr Lal Path Labs Q4

>> Consolidated Profit at Rs 32.5 crore

>> Consolidated revenue Rs 302 crore

>> EBITDA margin at 19%

>> Consolidated revenue Rs 302 crore

>> EBITDA margin at 19%

2:22 PM

BROKERAGE VIEW :: Nomura on fiscal stimulus

The government has aimed for maximum bang for minimum buck, with most of the relief either regulatory in nature or reflecting in its contingent liabilities rather than explicit budgetary support. Meanwhile it has used the cover of the COVID-19 crisis to plough through long pending, politically sensitive structural reforms. As a result, the package may fall short of mitigating the near-term existential crisis for businesses and workers, but is better designed to improve India’s medium-term growth potential and attract long-term risk capital. As a consequence, we maintain our GDP growth projection for 2020 at -5% YoY

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: May 18 2020 | 7:40 AM IST