Investors richer by Rs 4 trn as Sensex zooms 765 pts, ends near 56,900

Investor wealth rose by Rs 3.6 trillion on the BSE today, taking m-cap of all listed BSE companies to Rs 247.34 trillion

)

Stock market updates: Indian equities hit fresh milestones on Monday as Jerome Powell's speech last Friday, suggesting no interest rate hike in the near future, boosted risky assets.

The frontline S&P BSE Sensex inched towards the 57,000-mark as it hit a new high of 56,958 in the intra-day deals. The Nifty50, meanwhile, came close to the 17,000-mark as it touched 16,949 levels.

By close, both the indices were at new closing highs of 56,890 and 16,931 levels, up 765 points and 226 points, respectively. The indices gained 1.4 per cent each. This was the indices best one-day gain since August 3, 2021.

In the broader markets, the BSE MidCap and SmallCap indices ended 1.7 per cent and 1.5 per cent higher, respectively. Sectorally, the Nifty Metal index advanced 2.5 per cent, followed by the Nifty Realty, Pharma, and Bank indices.

3:57 PM![]()

TECH VIEW :: Rohit Singre, Senior Technical Analyst at LKP Securities

Strong move has been witnessed on the first day of the week and the index closed a day on fresh highs at 16931 with gains of nearly one & a half per cent forming a strong bullish candle on the daily chart. The index reached its immediate targets of the 17k mark so traders are suggested to lock some gains near the 17k mark also fresh buying will be suggested on a dip near 16850 zone not here as risk rewards will not be in favour, immediate support for nifty is coming near 16850-16770 zone if managed to hold above-said levels we may see the index to breach 17k mark and resistance is coming near 17k mark.

3:57 PM

![]()

MARKET QUOTE :: Narendra Solanki, Head- Equity Research, Anand Rathi

Indian markets started on a positive note following positive Asian market cues on back of U.S. Fed chairman statement indicating that the central bank is likely to begin tapering before the end of the year, though there is still much ground to cover before rate hikes. During the afternoon session markets continued to trade positive and scaled new highs with broad based buying in blue chip counters. Most of the sectoral indices were trading in green. Apart from blue chips, broader indices too equally participated in the rally with both mid and small cap indices trading up by over 1.50% each. In another positive development, Niti Aayog Vice-Chairman has said a strong economic growth rebound is expected on the back of rapid vaccinations, a recovering monsoon boosting agricultural output, thrust on infrastructure investments by the government, and growth in export, which have performed remarkably during April June registering a growth of 18% over the same period in the pre-pandemic year of 2019-20.

3:56 PM![]()

CLOSING COMMENTS :: Vinod Nair, Head Of Research at Geojit Financial Services

Following a strong gap-up opening, equity benchmark indices maintained the trend throughout the day in line with the strength in global markets. Global markets strengthened as the anxiety over the Jackson Hole symposium subsided following the dovish tone of the Fed Chair. Jerome Powell stated to stick with the wait-and-see approach giving reassurance that the easy money policy will continue this year with a smaller rate of tapering.

3:55 PM

Zomato rallies 7% as Goldman Sachs initiates coverage with BUY

3:50 PM

Axis Bank up 4% as lender begins issuing debt securities under Rs 35,000 cr-debt raise plan

>> Axis Bank on Monday said it has started issuing debt securities under its Rs 35,000 crore-debt raise plan announced earlier this year.

3:49 PM

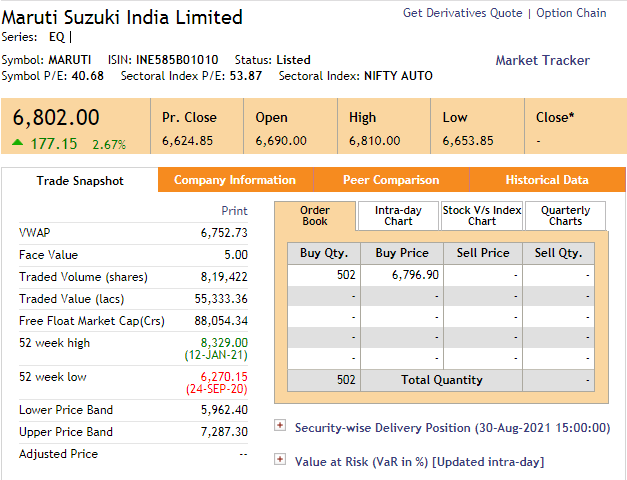

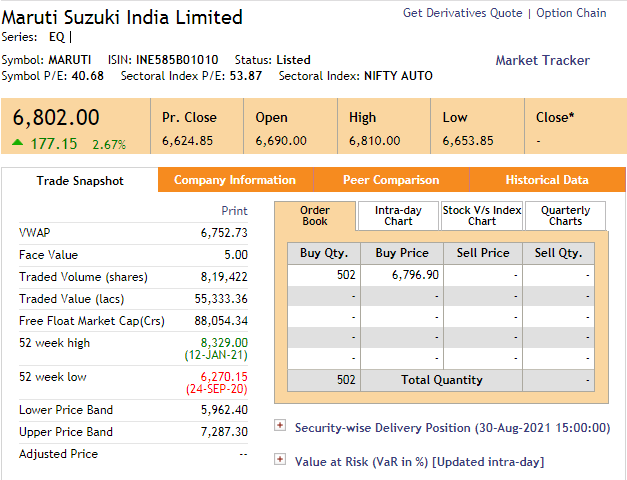

Maruti Suzuki jumps 3% as firm announces price hike for all models from Sept

>> The country's largest carmaker Maruti Suzuki India on Monday said it will hike prices across models from next month amid rising input costs. In a regulatory filing, the company said, ".... over the past year the cost of company's vehicles continue to be adversely impacted due to increase in various input costs."

3:48 PM

Airtel jumps over 4% on Rs 21,000 crore fund raising plan, chairman's comments

>> The telecom services provider announced Rs 21,000-crore rights issue on Sunday

>> Further, the company's chairman Sunil Mittal on Monday said that it was time to raise tariffs and the company eyes ARPU of Rs 200 by the end of this fiscal & Rs 300 eventually

>> Further, the company's chairman Sunil Mittal on Monday said that it was time to raise tariffs and the company eyes ARPU of Rs 200 by the end of this fiscal & Rs 300 eventually

3:43 PM

NIFTY IT falls amid profit taking in IT names

3:43 PM

NIFTY METAL :: Tata Steel, Coal India top gainers in the metals pack

3:42 PM

SECTOR WATCH :: Barring Nifty IT, all sectors in the green

>> Metals & banking sectors rise over 2% each

3:41 PM

BSE SMALLCAP index gains 1.55%

>> Here are the top gainers & losers from the pack

3:39 PM

BSE MIDCAP :: Top gainers & losers

3:38 PM

BSE Midcap hits new high; outperforms benchmark Sensex

3:37 PM

Sensex Heatmap | Top gainers & losers at close

>> TOP GAINERS: Bharti Airtel, Axis Bank, Tata Steel

>> TOP LOSERS: Nestle India, TechM, Infosys

>> TOP LOSERS: Nestle India, TechM, Infosys

3:36 PM![]()

CLOSING BELL :: Sensex, Nifty end at record highs

>> The BSE Sensex and NSE Nifty closed at new record highs on Monday. The former rose 765 points to end at 56,890 and the latter at 16,931, up 226 points. During the day, Sensex touched new record high at 56,958. Meanwhile, Nifty50 vaulted past 16,800 and 16,900 levels to hit a new peak of 16,952.

Topics : MARKET LIVE MARKET WRAP Markets S&P BSE Sensex NSE Nifty SGX Nifty US Federal Reserve Wall Street Asian markets Global Markets News Midcap smallcap stocks Bharti Airtel Nazara Technologies Burger King IDBI Bank M&M stock market

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Aug 30 2021 | 8:15 AM IST