Fag-end selling drags Sensex 163 pts down; mid-caps gain; Voda Idea up 10%

Earlier in the day, the 30-share index scaled mount 56,000 and hit a fresh record high of 56,118. The Nifty50, on the other hand, hit a new high of 16,702

)

12:43 PM

ALERT :: Indices off highs as financial decline

12:35 PM![]()

84% in BofA Fund manager survey says US Fed will signal taper by year end

“Twenty-eight per cent of investors expect the Fed to signal tapering at Jackson Hole, 33 per cent of investors think September federal open market committee (FOMC) while 23 per cent of investors think Q4 2021. Note that the timing of the first-rate hike has been pushed back into 2023,” said the report. READ MORE

12:20 PM

![]()

After a week listing for Windlass Biotech, should investors apply for the upcoming IPOs?

Windlas Biotech got listed at a 4.5% discount to its issue price of Rs 460, despite the IPO getting a good response from investors and getting oversubscribed by more than 22 times. Currently, the stock is trading at Rs 392 which is down by 14.7% from its IPO price.

Earlier, we have seen some of the IPOs getting listed at discount to its IPO price like Macrotech Developers and after the listing, the stock has recovered and given good returns to investors. This was on the back of good fundamentals and recovery in the sector.

We suggest investors look at the fundamentals of the company before applying to an IPO, as we have seen that companies having good fundamentals give good returns on listing day or after the listing.

For the upcoming IPOs, we suggest investors be cautious as a lot of the upcoming IPOs are at aggressive valuations. We believe that a company having good fundamentals along with it being priced at reasonable valuations improves the chances of getting listing gains significantly.

-- Yash Gupta Equity Research Associate, Angel Broking

-- Yash Gupta Equity Research Associate, Angel Broking

12:07 PM

NIFTY FMCG best sectoral performer at this hour, up 1%

>> Here are the top gainers from the pack

11:44 AM

![]()

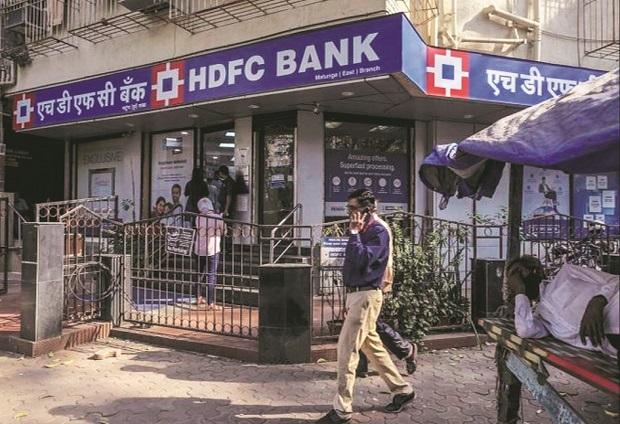

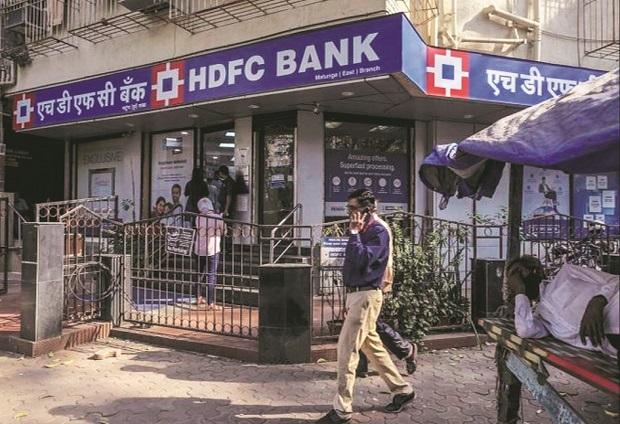

Lifting of credit card ban may spark up to 32% rally in HDFC Bank: Analysts

The Reserve Bank of India’s (RBI’s) nod to lift ban on issue of new credit cards may trigger an up to 32 per cent rally in the lender’s stock, believe analysts, as the lift has come ahead of festive season, presenting an opportunity to capture market share. The scrip surged 3 per cent at Rs 1,564.75 on the BSE in intra-day trade on Wednesday and was among the top gainers on the BSE barometer. READ MORE

11:41 AM

![]()

Bajaj Finance joins Rs 4 trillion m-cap club as stock hits record high

Non-banking finance company (NBFC) Bajaj Finance hit Rs 4-trillion in market capitalisation (market cap) after its shares touched a record high of Rs 6,640.80, up 3.6 per cent on the BSE in intra-day trade on Wednesday. The stock surpassed its previous high of Rs 6,475 touched on August 4, 2021. READ MORE

11:15 AM

![]()

MARKET VIEW :: Investors have to be cautious while committing fresh funds

The market has been consistently surprising even the incorrigible optimists by setting new records. The Sensex has scaled the 56000 mark this morning. It is interesting to note that the Sensex has multiplied 560 times since its inception with 1979 as the base year. By averaging around 15% CAGR during the last 42 years, Sensex has rewarded long-term investors handsomely. However, the journey of the market has been volatile with sharp ups and downs unnerving the short-term investors and traders. The future would be no different.

The present bull run primarily driven by the new retail investors is in an overbought, richly valued zone. This year metal index has been the outperformer with Nifty Metal Index leading with 76 % return followed by the Nifty IT Index with 38% return. But it is important to remember that even sectors with good earnings visibility, like IT and metals, are highly valued. Therefore, even while remaining invested in this bull market, investors have to be cautious while committing fresh funds.

-- Dr. V K Vijayakumar, Chief Investment Strategist at Geojit Financial Services

-- Dr. V K Vijayakumar, Chief Investment Strategist at Geojit Financial Services

11:05 AM![]()

Rupee, inflation, stocks: What sets gold prices in India during Covid-19

Gold is India's most popular investment option and the country is one of the largest consumers of the metal, contributing around 25 per cent of the global demand. Gold is regarded a safe investment, especially during economic and financial crises. Investors use gold as an instrument to shield their portfolio investment. Gold prices fluctuate in financial and political uncertainties as well as changes in interest and exchange rates, government policies and other reasons. READ MORE

10:58 AM

![]()

Infosys hits new high, trades above share buyback price of Rs 1,750

Shares of Infosys hit a new record high of Rs 1,755, up nearly 1 per cent on the BSE in intra-day trade on Wednesday. At 10:18 am, the stock was trading at Rs 1,751.75, above its maximum share buyback price of Rs 1,750 per share.

The IT major had commenced share buyback programme worth Rs 9,200 crore on June 25, 2021, wherein it had proposed to buy back shares at a maximum price of Rs 1,750 apiece. READ MORE

10:41 AM![]()

Jubilant FoodWorks hits new high, surges 35% in a month on growth prospects

For Q1FY21, JFL reported a consolidated net profit of Rs 69.06 crore in the first quarter ended June 30, aided by higher revenues despite the second wave of Covid-19 disrupting operations. It had posted a consolidated net loss of Rs 74.47 crore in the same quarter last fiscal. Ebitda (earnings before interest, taxes, depreciation, and amortisation) margins remained unchanged at 24.1 per cent in Q1FY22 as against 24.3 per cent in Q4FY21. READ MORE

10:25 AM

NIFTY IT reverses losses, hits new high

>> Barring Wipro, all stocks in the IT pack traded on a strong note

10:09 AM![]()

As stock markets surge, focus is on 'insider' selling gathering steam

Selling by “insiders” has picked up amid stocks scaling new highs. In July, they sold shares worth more than Rs 10,000 crore, and in June and May around Rs 7,000 crore each. Selling had slowed during April following a correction in the market due to the lethal second wave of the pandemic. READ MORE

9:55 AM![]()

HDFC Bank gains 3% as RBI allows lender to issue new credit cards

Despite today’s gain, in the past three months, the stock of HDFC Bank has underperformed the market by gaining 7.5 per cent, as compared to a 13 per cent rally in the S&P BSE Sensex. In the six months, the stock was down 2.5 per cent, against an 8.4 per cent gain in the benchmark index. It hit a record high of Rs 1,650 on February 24, 2021. READ MORE

9:38 AM![]()

MARKET VIEW | V K Vijayakumar, Chief Investment Strategist at Geojit Financial Services

The outperformance of large-caps, aided by the robust performance of IT majors, is likely to continue as the froth in the broader market is slowly getting removed. This is a healthy sign. An important trigger for the market today would be the good news for HDFC Bank. RBI's decision to partially remove restrictions on credit card issuances by HDFC Bank would help this bluechip regain some of its lost shine. This would be favourable to Bank Nifty too which has been underperforming this year. But it is important to understand that partly the good news is already in the price since HDFC Bank is up by 6% this month, perhaps in anticipation of the positive development. Meanwhile, retail investors continue to buy aggressively in the market unmindful of the excessive valuations, particularly in the broader market. It's time to move over to the safety of large-caps from the over-valued mid-and small-caps.

9:37 AM

Bharat Dynamics up 2% on agreement with MBDA

>> The company signed agreement with MBDA to establish advanced short range air-to-air missile facility in India.

Topics : MARKET LIVE MARKET WRAP HDFC Bank Hindustan Aeronautics Canara Bank Global Markets SGX Nifty S&P BSE Sensex Nifty50

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Aug 18 2021 | 8:08 AM IST