Sensex falls 215 pts post RBI policy; Nifty at 16,238; RIL sheds 2%

Stock market LIVE: The RBI pegged real GDP growth forecast for FY22 at 9.5 per cent and at 17.2 per cent for FY23.

)

3:37 PM

Sensex Heatmap | Top gainers & losers at close

>> Top gainers: IndusInd Bank, Tech Mahindra, Bharti Airtel, Maruti

>> Top losers: Reliance Industries, Ultratech Cement, Tata Steel, HCL Tech

>> Top losers: Reliance Industries, Ultratech Cement, Tata Steel, HCL Tech

3:33 PM![]()

CLOSING BELL :: Sensex, Nifty end lower for the first time in five days

The domestic benchmark indices snapped their 4-session winning run as they ended lower on Friday, with Reliance Industries as the biggest drag. The 30-pack Sensex closed the day at 54,278, down 215 points or 0.39%. Meanwhile, NSE Nifty settled the day 56 points or 0.35% down at 16,238.

3:28 PM![]()

MARKET VOICE :: Policy normalisation process has already kicked off

India’s economic activity picked up pace in June-July as some states eased pandemic containment measures. High-frequency indicators – e-way bills; toll collections; electricity generation; air traffic; railway freight traffic; port cargo; steel consumption, cement production; import of capital goods; passenger vehicle sales; two-wheeler sales – posted decent growth in June/July, reflecting adaptations to COVID related protocols and easing of containment. RBI kept its real GDP projection unchanged at 9.5% for FY22 (18.5% in Q1; 7.9% in Q2; 7.2% in Q3; and 6.6% in Q4 of 2021-22; 17.2% in Q1 of 2022-23).READ MORE

Deepak Jasani - HDFC Securities

3:04 PM

June Quarter Results :: Berger Paints

>> PAT: Rs 140 crore

>> Revenue: Rs 1,758 crore

>> Revenue: Rs 1,758 crore

2:47 PM

![]()

Amazon vs Future Grp: Tech charts show 20% downside in Future Group stocks

Future Retail Limited (FRETAIL)

Likely target: Rs 48 to 46

Downside potential: 7.50% to 11.50%

Since mid-July, the stock has made several attempts to cross 200-DMA, placed around Rs 72 mark, but failed to do so amid lack of support from volumes and technical indicators like RSI and Moving Average Convergence Divergence (MACD). Today, the stock hit 10 per cent lower circuit limit, breaching 100-DMA, suggesting bearish sentiment for coming sessions. The stock may see a downside towards Rs 48 and 46 levels, as per the daily chart. READ MORE

2:34 PM

JUNE QUARTER RESULTS :: HINDALCO

>> PAT at Rs 2,787 crore vs loss of Rs 709 crore

>> Revenue at Rs 41,358 crore versus Rs 25,283 crore

>> EBITDA at Rs 6,790 crore

>> Revenue at Rs 41,358 crore versus Rs 25,283 crore

>> EBITDA at Rs 6,790 crore

2:19 PM

June Quarter Results :: Muthoot Finance slides sharply after Q1 result

>> Standalone PAT: Rs 971.1 crore

>> Standalone revenue: Rs 2,713.7 crore

>> Standalone revenue: Rs 2,713.7 crore

2:08 PM

>> MSF and TLTRO (on tap) to continue toll December.

>> We expect 10 year bond to inch upwards now. It is at 6.24% now compared with 6.20% yesterday. Clearly the bond market expects higher yields. We look at a range of 6.2-6.3% for next two months.

Bond Market Alert :: CARE Ratings expect bond yields to edge higher

The agency's interpretation of RBI Policy:

>> V3R will continue with larger amounts – though this should not be interpreted as liquidity tightening.

>> V3R will continue with larger amounts – though this should not be interpreted as liquidity tightening.

>> MSF and TLTRO (on tap) to continue toll December.

>> We expect 10 year bond to inch upwards now. It is at 6.24% now compared with 6.20% yesterday. Clearly the bond market expects higher yields. We look at a range of 6.2-6.3% for next two months.

1:57 PM![]()

Subdued revenue spend may hit economic recovery, say economists

The Centre’s capital expenditure saw a robust double-digit growth in the first quarter of financial year 2021-22 (Q1FY22) year-on-year, but the decline in revenue expenditure may drag economic recovery, economists warn. Revenue expenditure, which plays a key role in propelling demand in the economy, saw a 2.4 per cent decline in Q1, led by a sharp reduction in rural expenditure. READ MORE

1:47 PM![]()

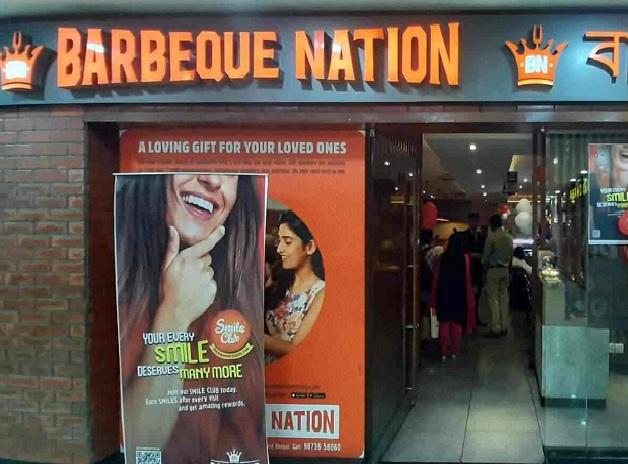

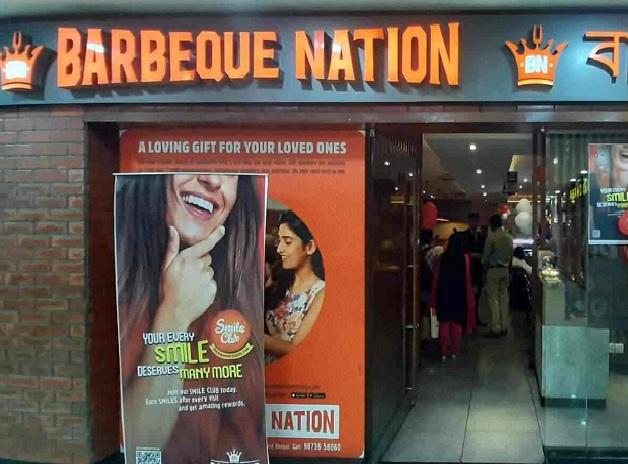

Barbeque Nation Hospitality zooms 37% in 4 days after strong Q1 results

Shares of Barbeque Nation Hospitality surged 18 per cent to Rs 1,215 on the BSE in the intra-day trade on Friday, gaining 37 per cent in the the past four trading days, after the company reported a strong recovery in sales at 86 per cent in July 2021 as compared to the same month of the previous year. The stock was trading at its highest level since its market debut on April 7, 2021. With the past four days' rally, it has zoomed 143 per cent from its issue price of Rs 500 per share. READ MORE

1:31 PM![]()

RBI POLICY VIEW :: Naveen Kulkarni, Chief Investment Officer, Axis Securities

RBI remains supportive of getting the economic growth on track, continuing with a soft interest rate regime and maintaining liquidity conditions in the system. On expected lines, the RBI kept policy rates unchanged for the seventh consecutive time and maintained its accommodative stance. The higher inflation trends over the past few months led to upward revision in CPI inflation from 5.1% to 5.7%. However, GDP forecasts for FY22 were maintained at 9.5%, indicating that the focus is clearly on growth. While there were no big bang announcements today, extension given to the earlier measures announced is positive since some sectors are yet to fully recover from the second wave of Covid-19 impact. We believe Housing Finance Companies such as HDFC, CanFin Homes and Large banks such as SBI, ICICI Bank are comfortably placed as interest rates remain in a sweet spot.

1:23 PM

NEWS ALERT :: RITES wins orders from Indian railways for Rs 4,000 crore

RITES has received Letter of Acceptance for execution of three new railway line turnkey projects from Ministry of Railways

1:18 PM![]()

RBI POLICY VIEW :: Jyoti Roy - DVP- Equity Strategist, Angel Broking

The MPC took cognizance of the fact that the last two inflation readings for May and June at 6.3% were well above higher end of the RBIs comfort zone 6.0% Moreover the RBI has observed that inflationary pressures are exogenous and largely temporary due to supply shocks. We expect the RBI will continue to maintain their accommodative monetary policy given that the high inflation levels are transitory in nature and should start coming off in the second half of the year.

Moreover the recovery from the second Covid wave is still nascent and needs to be nurtured and we expect the RBI will continue to use all tools available including OMOs, G-SAP, TLTRO, operation twist etc. to ensure that longer term interest rates are well anchored and there is adequate credit flows to the most stressed sectors.

Moreover the recovery from the second Covid wave is still nascent and needs to be nurtured and we expect the RBI will continue to use all tools available including OMOs, G-SAP, TLTRO, operation twist etc. to ensure that longer term interest rates are well anchored and there is adequate credit flows to the most stressed sectors.

1:17 PM

![]()

Mid-market view | Likhita Chepa, Senior Research Analyst, CapitalVia Global Research

The Indian benchmark is trading with a small negativity after 16,300. We have observed a lackluster movement after continuous positivity in the market. RBI policy has no major impact on the market as the policy came on expected lines of the investors that there will be no change in the repo rate. There is no change in the growth rate as well despite of the inflation concerns in the market which can give boost to the confidence of the investors in the recovery of the economy. Our research suggests 16200 will be an important support level in the market for the market to remain positive in the short term.

12:57 PM

![]()

Adani Enterprises jumps 7%, claims title of most valuable Adani Group firm

Shares of Adani Enterprises rallied 7 per cent to Rs 1,528.30 on the BSE in intra-day trade on Friday, bouncing back 8 per cent from its day's low of Rs 1,417 on the back of heavy volumes. The stock had hit a record high of Rs 1,718.45 on June 7, 2021. Trading volumes on the counter jumped 1.6 times, with a combined 9.74 million equity shares having changed hands on the NSE and BSE till 12:19 pm. In comparison, the S&P BSE Sensex was down 0.24 per cent at 54,363 points. READ MORE

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Aug 06 2021 | 8:17 AM IST